Green energy and transport

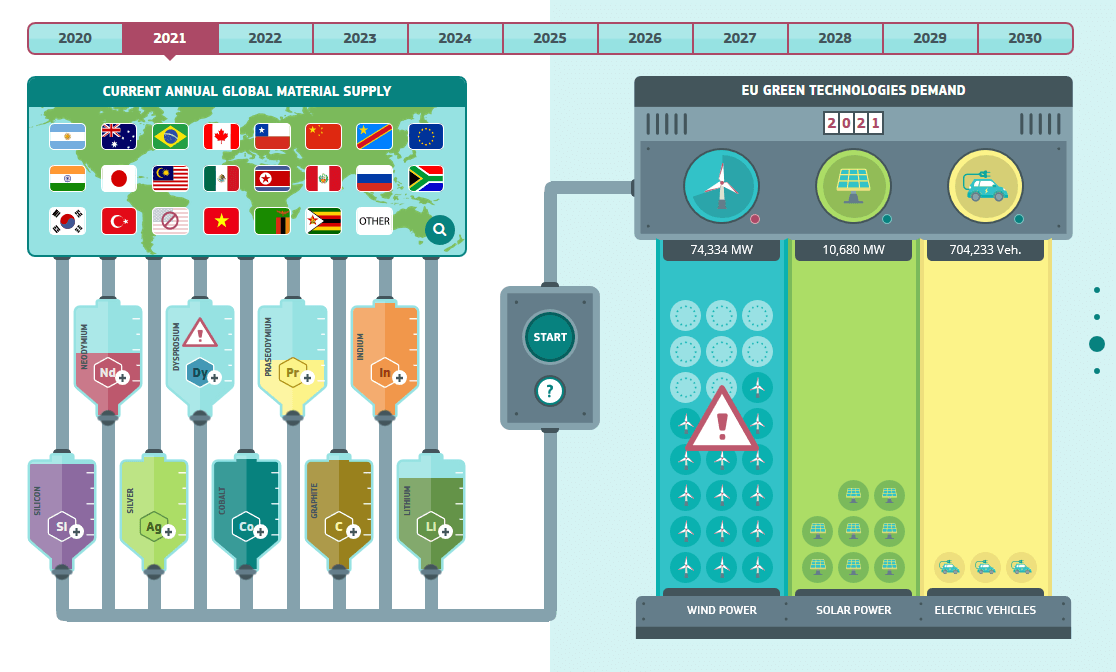

In the context of the 2019 Raw Materials Week event – November 18-22, Brussels – a new interactive tool developed by JRC was presented. The tool provides knowledge on raw materials supply chains with focus and on future green energy and transport technologies. As these technologies require raw materials that are, or may be short in supply, the tool provides quantitative understanding over the magnitude of the issues related to securing adequate raw materials supply for Europe until 2030. It also helps identify if and how any shortage or such raw materials would affect EU green technologies (wind power, solar power, electric vehicles), with a view to identify mitigation tactics.

For more info and access to the interactive tool click here.

Raw materials for wind energy, solar energy and mobility

As part of the European Green Deal, the EU has pledged to become carbon neutral by 2050. For that it is necessary to shift the energy system from fossil fuels to renewable sources. The rate of deployment of wind turbines and solar panels is then expected to increase rapidly, and so will the demand of raw materials needed to build them. This factsheet gives an overview of the 2030 and 2050 demand for structural and technology-specific materials for wind turbines and solar photovoltaics. The generation capacity and lifetime of the deployed infrastructure, the market share of each sub-technology, and the material usage intensity were assessed.* The foreseen demand will increase for most materials but varies very strongly depending on these factors; this makes different policy options more likely effective for each case.

Forecast raw material demand (relative to 2018) for wind and solar energy technologies (below).

Materials have been grouped according to the technology (offshore wind, onshore wind, solar) and whether they are structural or technology-specific. The darker area of each vertical bar represents the demand range assuming a moderate contribution from each factor which affects the demand. The lighter area represents the demand variability, estimated considering the best and worst combination of all factors.

Technology-specific materials for wind energy

The overall demand for neodymium, dysprosium, praseodymium, terbium and boron will most likely increase, more so for onshore than for offshore wind due to the difference in their forecast capacity (right). Deploying wind energy according to the EU plans for 2050 could require by itself more dysprosium and terbium than currently available to the EU market. Substitution could help alleviate the pressure on the supply chain, by reducing the use of some specific rare earths in wind-turbine drive systems or even eliminating them altogether; however, this would require significant R&D policy interventions, since permanent-magnet wind technologies are steadily gaining market share and their composition is currently well established.**

Rare Earth Elements (REEs) for wind turbine and mobility

A transition towards renewables and low-emission mobility is needed for a carbon neutral Europe and to implement the ambitions of the Green Deal. This turns in the increasing demand of raw materials among which critical raw materials (CRMs), e.g. rare earth elements ( REEs) which are embedded in permanent magnets used in both wind turbines and electric motors. These materials are mainly supplied by China, which currently accounts for over 60% of their extraction, and for more than 90% of their refining. In the long term, investments in supply and in recycling technologies recovering secondary REE will be important for the EU.

Information, data and forecasts on such a topic can be found in the recent JRC report “The role of rare earth elements in wind energy and electric mobility.”****

Technology-specific materials for solar energy

The demand for technology-specific material for solar energy (germanium, cadmium, tellurium, silicon, selenium, gallium, indium and silver) largely depends on the relative market share of different photovoltaic technologies. This could give the industry more flexibility than for wind energy, and might also make policy interventions more effective in favouring one material over another. Crystalline silicon will remain a key component for solar technology in the coming years, but considering the currently available amounts the supply chains for tellurium, indium and germanium are more likely to be subject to a stronger pressure in the future.

Structural materials

The need for structural materials (concrete, steel, plastic, glass, iron, chromium, copper, aluminium, manganese, nickel, zinc and molybdenum) is expected to increase for both wind and solar technologies. No supply problems are expected even in the worst-case scenario, since the current availability vastly exceeds the foreseen demand. However, the steel and cement sectors are both major greenhouse gas emitters, and decarbonising their production processes is challenging; for example, incremental efficiency improvements to the current primary steel production methods could only reduce emissions by 10%.*** A large increase in their demand before new technologies take over could worsen the issues related to their sustainability and environmental impact.

* Carrara, S.; Alves Dias, P.; Plazzotta, B.; Pavel, C.; Raw materials demand for wind and solar PV technologies in the transition towards a decarbonized energy system, Publications Office of the European Union, Luxembourg, 2020, doi:10.2760/160859, JRC119941. ** Vázquez Hernández, C.; Telsnig, T.; Villalba Pradas, A.; JRC Wind Energy Status Report, Publications Office of the European Union, Luxembourg, 2017, doi:10.2760/332535, JRC105720. *** Somers, J.; Moya, J.; Decarbonisation of industrial heat: The iron and steel sector, European Commission, Petten, The Netherlands, 2020, JRC119415. **** Alves Dias, P., Bobba, S., Carrara, S., Plazzotta, B. (2020), The role of rare earth elements in wind energy and electric mobility, EUR 30488 EN, Publication Office of the European Union, Luxembourg, ISBN 978-92-79-27016-4, doi:10.2760/303258, JRC122671