More on Critical Raw Materials

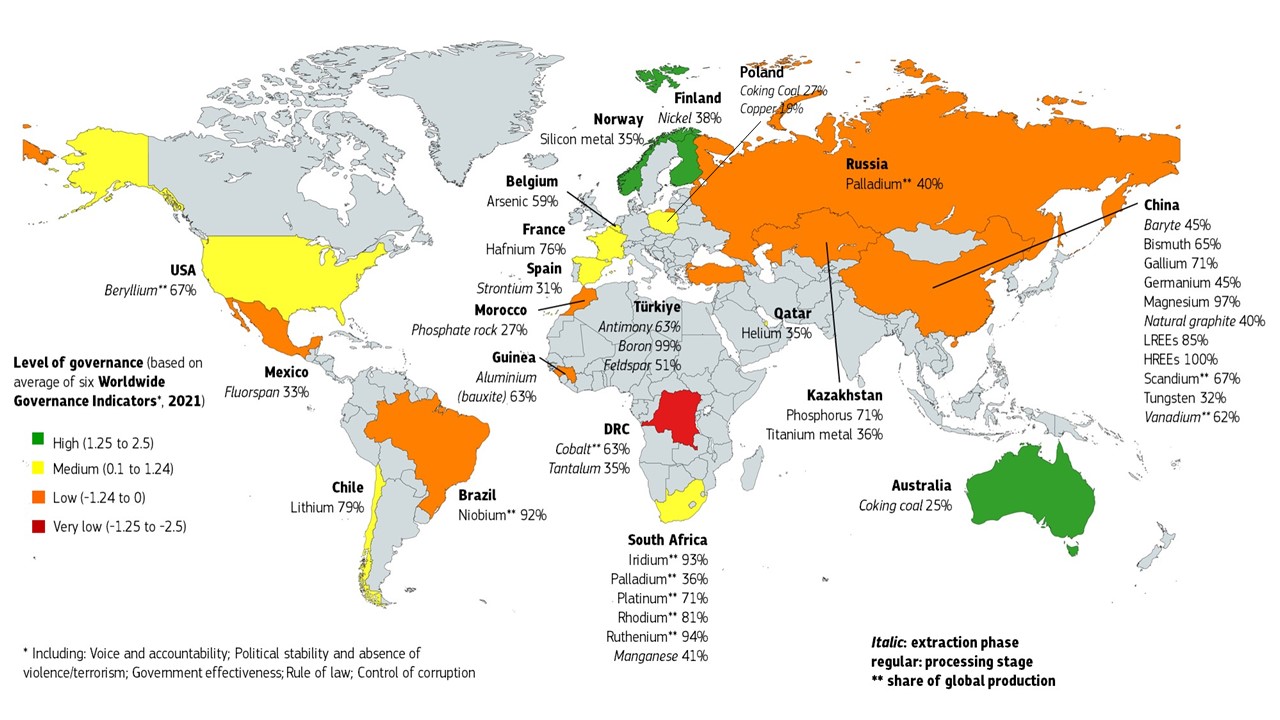

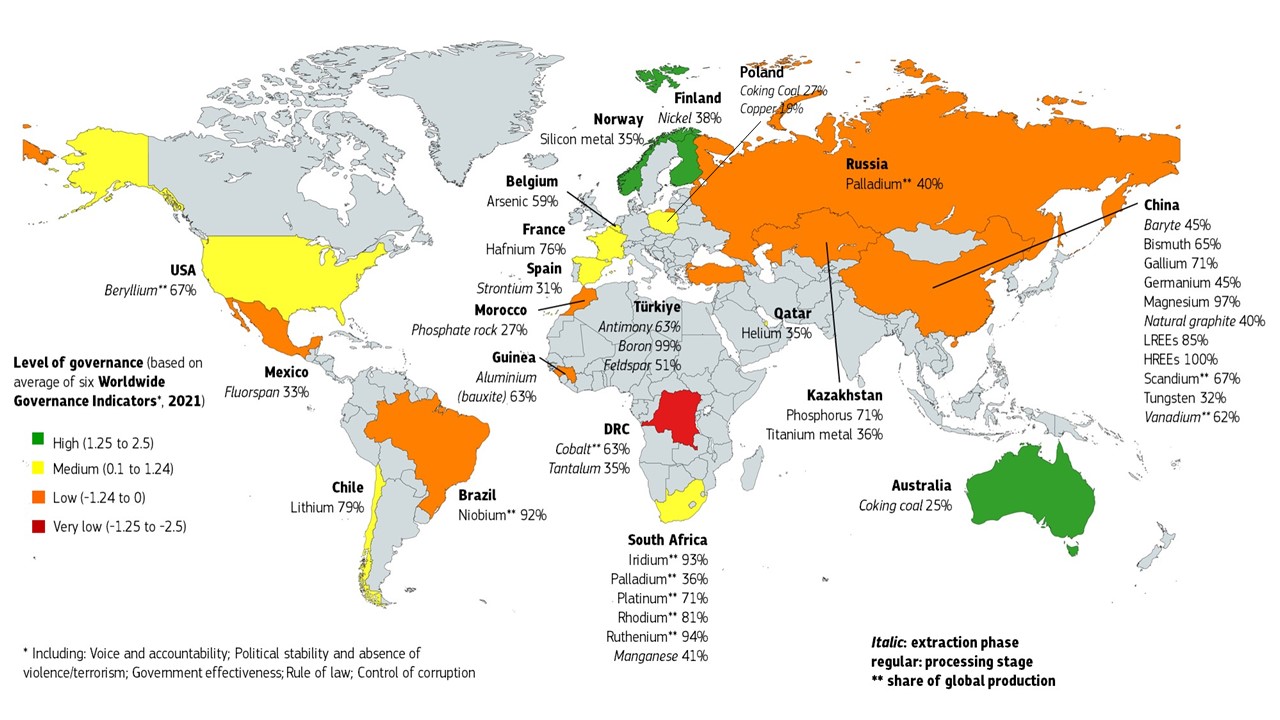

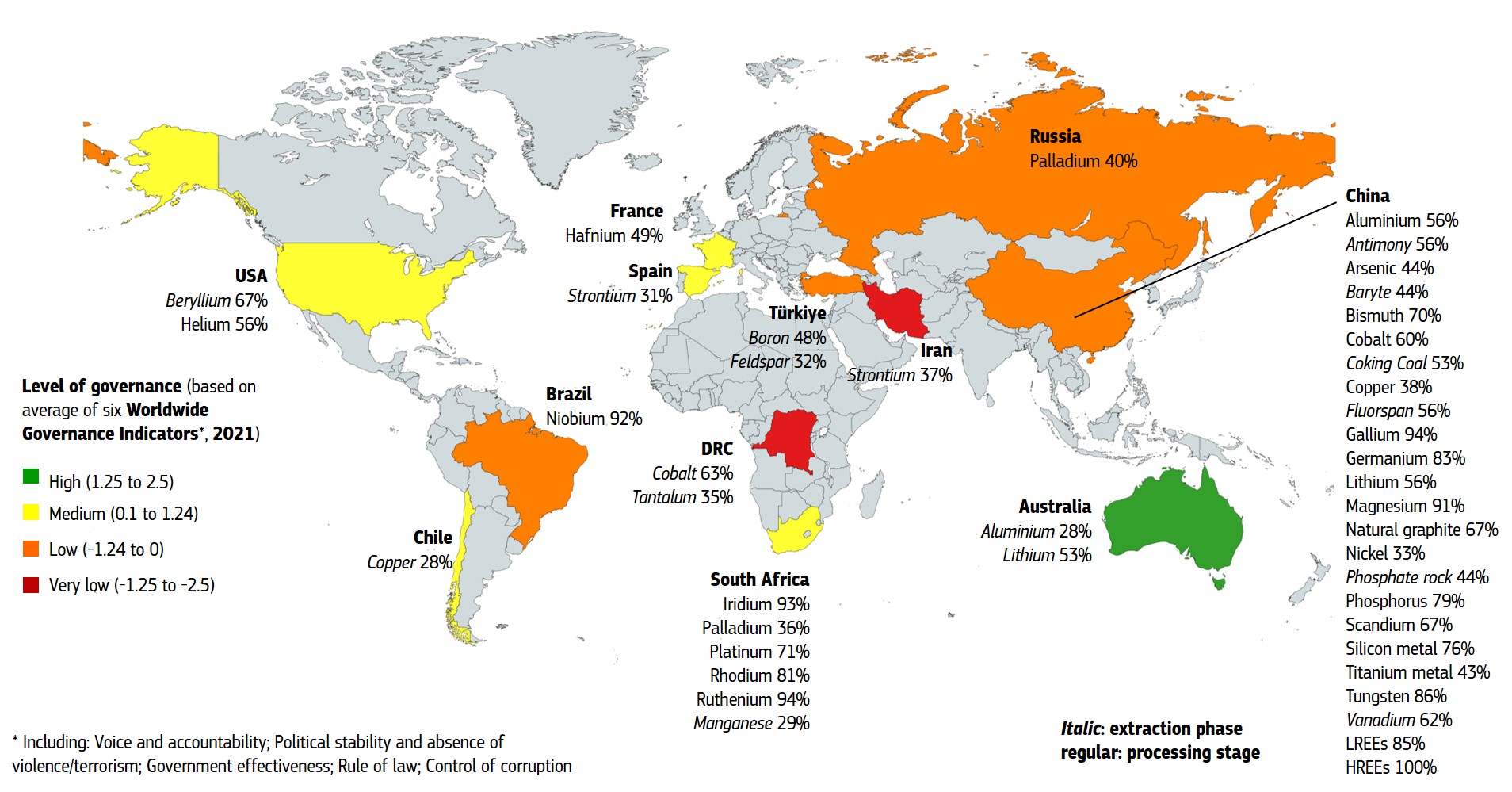

Raw materials form the basis of Europe’s economy to ensure jobs and competitiveness, and they are essential for maintaining and improving quality of life. Although all raw materials are important, some of them are of more concern than others in terms of secure and sustainable supply.

The European Commission carries out a criticality assessment at EU level on a wide range of raw materials every three years, led by DG GROW.

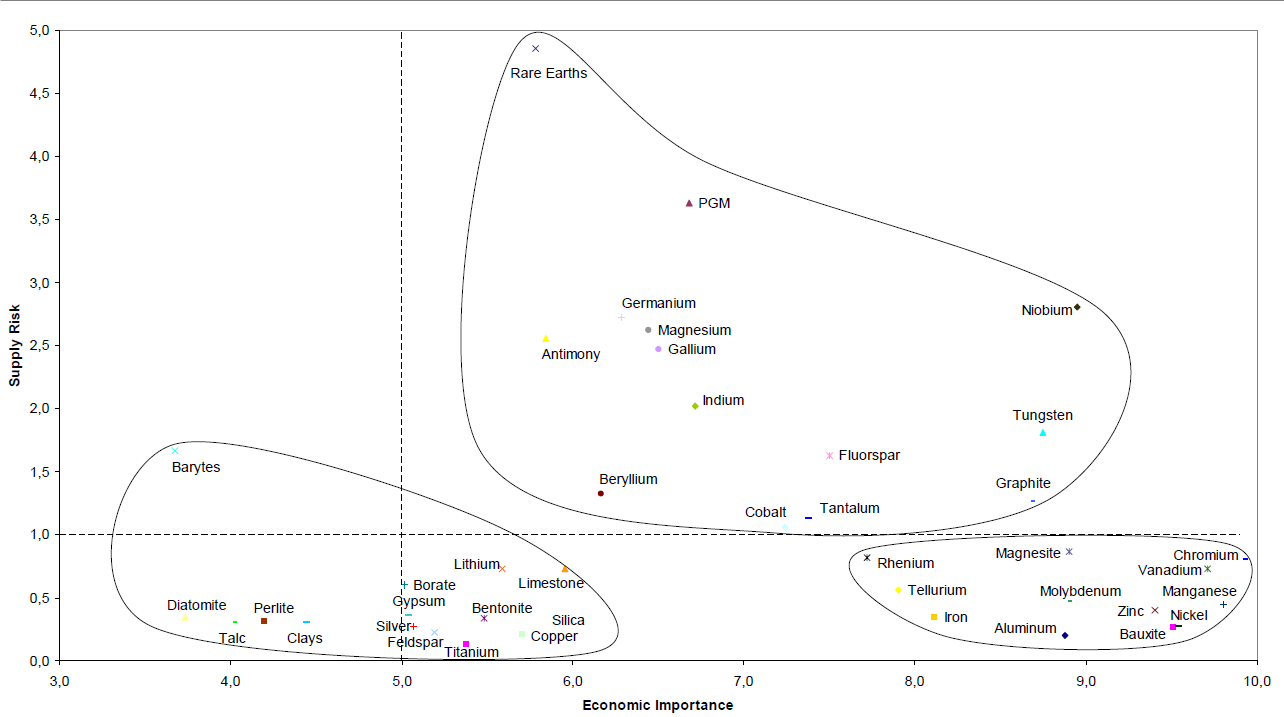

Critical Raw Materials are both of high economic importance for the EU and have a high risk of supply disruption. A complete explanation of the methodology to identify the list of critical and strategic raw materials can be found here

- Study on the review of the list of Critical Raw Materials 2017

- JRC Report on the revised criticality assessment methodology - Background report

- Annex 1 and 2 of the 2024 Critical Raw Materials Act.

Candidate CRMs to be assessed were 41 in 2010, 54 in 2013, 78 in 2016 and 83 in 2019. The resulting lists of CRMs for the EU were composed by 14, 20, 27, 30 and 34 raw materials in 2011, 2014, 2017,2020 and 2023, respectively.

In 2023, a list of also 16 Strategic Raw Materials is identified. The list of critical raw materials includes the strategic raw materials.

Additional material specific information available at the RMIS pages:

COM(2023) 160 ANNEX 1 to 6 - Annexes to the Proposal for a regulation of the European Parliament and of

the Council establishing a framework for ensuring a secure and sustainable supply of critical raw

materials – present a list of Strategic Raw Materials (Annex 1) and Critical Raw Materials (Annex

2):

https://single-market-economy.ec.europa.eu/publications/european-critical-raw-materials-act_en

Study report:

https://op.europa.eu/en/publication-detail/-/publication/57318397-fdd4-11ed-a05c-01aa75ed71a1

The list of critical raw materials includes the strategic raw materials as well as any other raw material that reaches or exceeds the thresholds for both economic importance and supply risk, as defined in this proposed regulation.

Further information can be found at:

https://single-market-economy.ec.europa.eu/sectors/raw-materials/areas-specific-interest/critical-raw-materials_en

|

2023 Critical Raw Materials (34) |

|||

|---|---|---|---|

|

Antimony |

Copper |

Lithium |

Scandium |

|

Arsenic |

Feldspar |

Magnesium |

Silicon metal |

|

Aluminium/Bauxite |

Fluorspar |

Manganese |

Strontium |

|

Baryte |

Gallium |

Natural Graphite |

Tantalum |

|

Beryllium |

Germanium |

Nickel – battery grade |

Titanium metal |

|

Bismuth |

Hafnium |

Niobium |

Tungsten |

|

Boron/borates |

Helium |

Phosphate rock |

Vanadium |

|

Cobalt |

Heavy Rare Earth Elements |

Phosphorus |

|

|

Coking Coal |

Light Rare Earth Elements |

Platinum Group Metals |

|

Copper and nickel do not meet the CRM thresholds but are included on the CRM list as strategic raw materials in line with the Critical Raw Materials Act (referimento: DG GROW website)

|

2023 Strategic Raw Materials (16) |

|||

|---|---|---|---|

|

Bismuth |

Gallium |

Manganese - battery grade |

Rare Earth Elements for magnets (Nd, Pr, Tb, Dy, Gd, Sm, and Ce) |

|

Boron - metallurgy grade |

Germanium |

Natural Graphite - battery grade |

Silicon metal |

|

Cobalt |

Lithium - battery grade |

Nickel - battery grade |

Titanium metal |

|

Copper |

Magnesium metal |

Platinum Group Metals |

Tungsten |

The 2020 assessment covers a larger number of materials: 83 individual materials or 66 candidate raw materials comprising 63 individual and 3 grouped materials (ten individual heavy rare earth elements (REEs), five light REEs, and five platinum-group metals (PGMs)). Five new materials (arsenic, cadmium, strontium, zirconium and hydrogen) have been assessed. (COM(2020) 474 final)

The fourth list of critical raw materials for the EU (COM(2020) 474 final)

Of the 83 individual (66 candidate) raw materials assessed, the following 30 were identified as critical in this assessment:

|

2020 Critical Raw Materials (30) |

|||

|---|---|---|---|

|

Antimony |

Fluorspar |

Magnesium |

Silicon Metal |

|

Baryte |

Gallium |

Natural Graphite |

Tantalum |

|

Bauxite |

Germanium |

Natural Rubber |

Titanium |

|

Beryllium |

Hafnium |

Niobium |

Vanadium |

|

Bismuth |

HREEs |

PGMs |

Tungsten |

|

Borates |

Indium |

Phosphate rock |

Strontium |

|

Cobalt |

Lithium |

Phosphorus |

|

|

Coking Coal |

LREEs |

Scandium |

|

The 2020 list confirms 26 of the 2017 CRMs. Three CRMs in the 2020 list were not considered as critical in the 2017 list: Bauxite, Lithium and Titanium. Conversely, Helium, critical in the 2017 CRM list, is no longer in 2020. Strontium is the only new candidate material that is in the 2020 list of CRMs.

All raw materials, even when not classed as critical, are important for the EU economy. The fact that a given material is classed as NFNF-critical does not imply that availability and importance to the EU economy can be neglected. Moreover, the availability of new data and possible evolutions in EU and international markets may affect the list in the future.

The full documentation about the 2020 CRMs list can be downloaded:

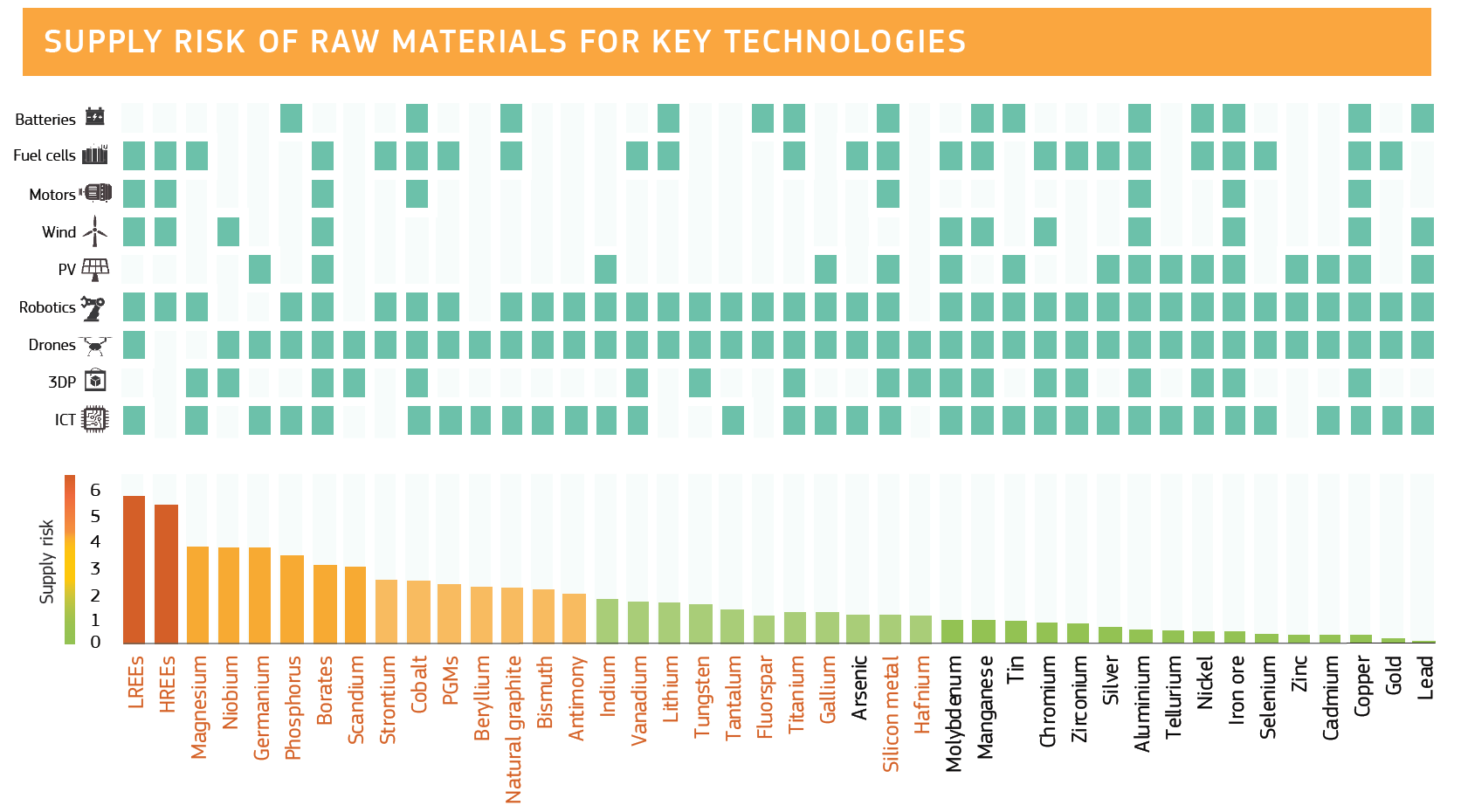

JRC foresight study for CRMs in strategic technologies and sectors in the EU

Critical Raw Materials are essential for the EU to deliver on the climate ambition of the European Green Deal. The objective of no net emissions of greenhouse gases by 2050 will require electrification efforts and the diversification of our sources of energy supply which in turn requires a huge increase in raw materials.

JRC published a foresight study, which accompanies the fourth list of CRMs for the EU and translates the climate-neutrality scenarios for 2030 and 2050 into the estimated demand for raw materials.

Such a report provides a systematic analysis of supply chain dependencies for nine selected technologies used in three strategic sectors: renewable energy, e-mobility, defence and aerospace.

The report indicates that for batteries for electric vehicles and energy storage, we would need up to 18 times more lithium and 5 times more cobalt in 2030, and almost 60 times more lithium and 15 times more cobalt in 2050, compared to the current supply to the whole EU economy. Demand for rare earths used in permanent magnets, e.g. for electric vehicles, robots or wind generators, could increase tenfold. For our Hydrogen Strategy to succeed, we would need a reliable supply of platinum group metals for fuel cells and electrolysers.

Critical Raw Materials are also essential for shaping Europe’s digital future. According to the foresight study, 120 times the current EU demand of the rare earth neodymium could be required to provide data storage for the global data sphere in 2025.

These examples show that a secure supply of raw materials, both from primary and secondary sources together with continued research and innovation policies for substitution and more sustainable product design, is a sine qua NFNF for competitive and resilient EU industries, their recovery of the COVID-19 crisis and transition towards green and digital industries.

The report can be downloaded:

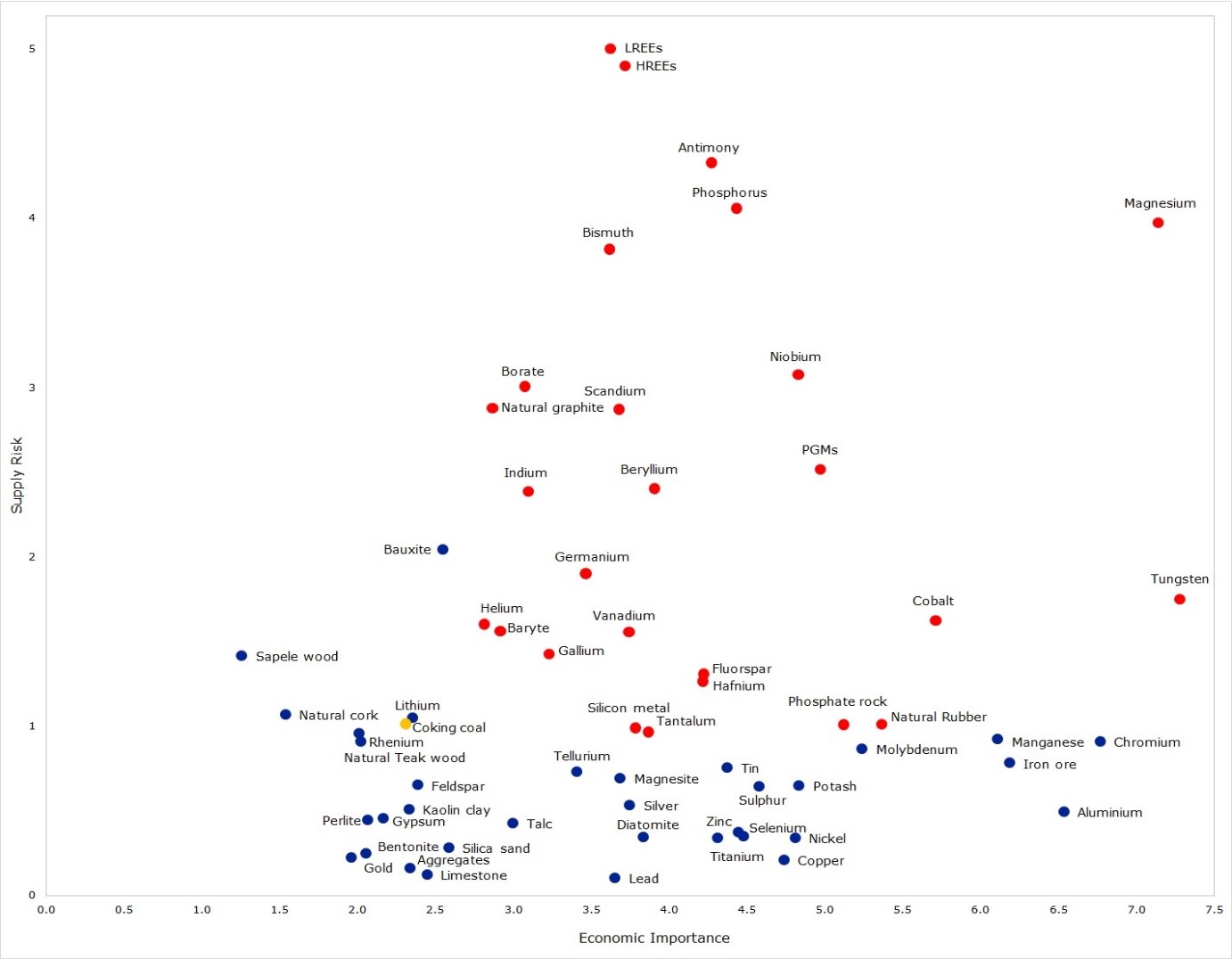

The EC criticality methodology is applied to both abiotic and biotic raw materials. The 2016 assessment considered 78 NFNF-energy, NFNF-agricultural raw materials. For the first time, individual assessment results are available for the HREEs, LREEs and PGMs.

The third list of critical raw materials for the EU

Of the 78 candidate raw materials assessed (58 individual and 3 grouped materials HREEs, LREEs and PGMs), the following 27 raw materials and groups of raw materials were identified as critical:

|

2017 CRMs (27) |

|||

|

Antimony |

Fluorspar |

LREEs |

Phosphorus |

|

Baryte |

Gallium |

Magnesium |

Scandium |

|

Beryllium |

Germanium |

Natural graphite |

Silicon metal |

|

Bismuth |

Hafnium |

Natural Rubber |

Tantalum |

|

Borate |

Helium |

Niobium |

Tungsten |

|

Cobalt |

HREEs* |

PGMs |

Vanadium |

|

Coking coal |

Indium |

Phosphate rock |

|

*HREEs=heavy rare earth elements, LREEs=light rare earth elements, PGMs=platinum group metals

The third list includes 9 more new materials than the 2014 list: baryte, bismuth, hafnium, helium, natural rubber, phosphorus, scandium, tantalum, vanadium. Three of these are entirely new to the list (bismuth, helium, phosphorus), as they were not assessed in 2014. The 2017 assessment identifies all 14 of the 2011 CRMs as critical. Compared to the 2011 CRMs list, the 2017 CRMs list includes ten additional critical raw materials: baryte, borate, vanadium, bismuth, hafnium, helium, natural rubber, phosphate rock, phosphorus and silicon metal. Chromium and magnesite that were classified as CRMs in 2014 are not in the 2017 list.

All raw materials, even when not classed as critical, are important for the EU economy.

The full documentation about the 2017 CRMs list can be downloaded:

- 2017 Study on the review of the list of Critical Raw Materials 2017

- 2017 JRC Report on the revised criticality assessment methodology - Background report

- 2017 JRC Report on the revised criticality assessment methodology - Annexes

- 2017 JRC Report on the revised criticality assessment methodology - Guidelines.

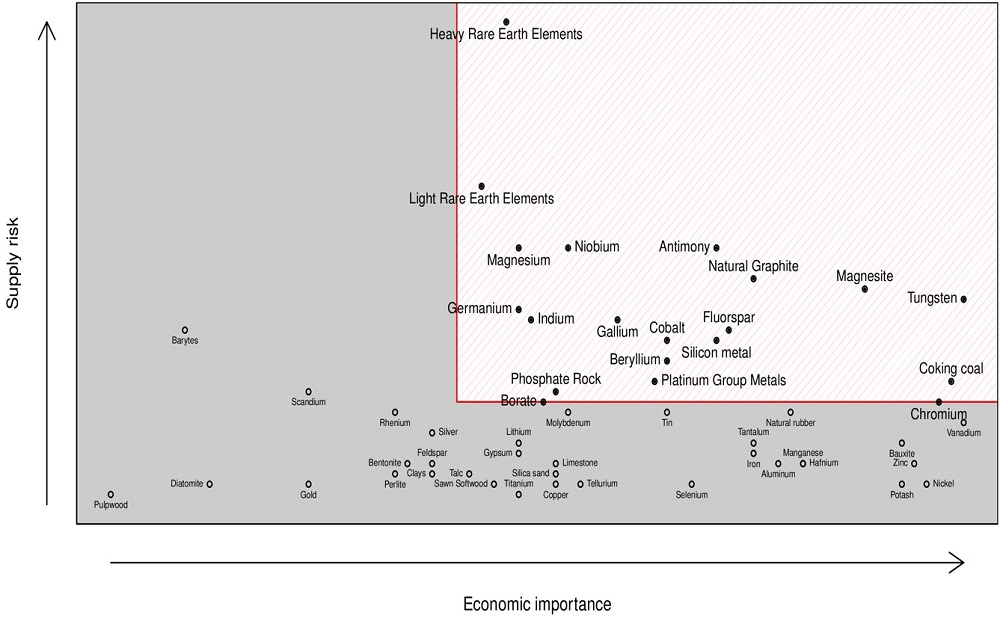

The EC criticality methodology is applied to both abiotic and biotic raw materials. The 2014 assessment considered 54 NFNF-energy, NFNF-agricultural raw materials.

In the 2013 criticality assessment 20 raw materials were identified as critical and included in the 2014 lis of CRMs for the EU, from the list of 54 candidate materials. Such list of CRMs included 7 new abiotic materials and 3 biotic materials. In addition, greater detail was provided for rare earth elements by splitting them into heavy rare earth elements, light rare earth elements, and scandium.

|

Antimony |

Beryllium |

Borates |

Chromium |

Cobalt |

Cooking coal |

Fluorspar |

|

Gallium |

Germanium |

Indium |

Magnesite |

Magnesium |

Natural Graphite |

Niobium |

|

PGMs |

Phosphate Rock |

REEs (Heavy) |

REEs (Light) |

Silicon Metal |

Tungsten |

This 2014 list included 13 of the 14 materials identified in the previous report, with only tantalum being removed from the EU critical material list. Six new materials enter the list: borates, chromium, coking coal, magnesite, phosphate rock, and silicon metal. Three of these are entirely new to the assessment. None of the biotic materials assessed were classified as critical. All raw materials, even when not critical, are important for the EU economy.

The full documentation about the 2014 CRMs list can be downloaded:

- 2014 Report on Critical Raw Materials for the EU (1 MB)

- 2014 Annex to the Report on Critical Raw Materials for the EU (577 kB)

- 2013 Study on Critical Raw Materials at EU Level (10 MB)

The 2011 assessment considered 41 NFNF-energy, NFNF-agricultural raw materials.

The 2011 list of CRMs for the EU included 14 raw materials:

|

Antimony |

Beryllium |

Cobalt |

Fluorspar |

Gallium |

|

Germanium |

Graphite |

Indium |

Magnesium |

Niobium |

|

PGMs |

REEs |

Tantalum |

Tungsten |

The full documentation about the 2011 CRMs list can be downloaded:

Factsheets 2023

Access and download SCRREEN FACTSHEETS

Further information can be found at:

https://single-market-economy.ec.europa.eu/sectors/raw-materials/areas-specific-interest/critical-raw-materials_en

Factsheets 2020

Download the full set of 2020 Critical Raw Materials Factsheets for

Factsheets 2017

Download the full set of 2017 Critical Raw Materials Factsheets for

Factsheets 2014

Download the full set of 2014 Critical Raw Materials Factsheets for

Assessing and publishing – every three years – an EU List of Critical Raw Materials is an action proposed as part of the Raw Materials Initiative (COM(2008) 699 final), which stated: “Furthermore, the Commission recommends that an integrated European strategy should, as a priority action, define critical raw materials for the EU. In this respect, the Commission proposes, in close co-operation with Member States and stakeholders, to identify a common list of critical raw materials.”

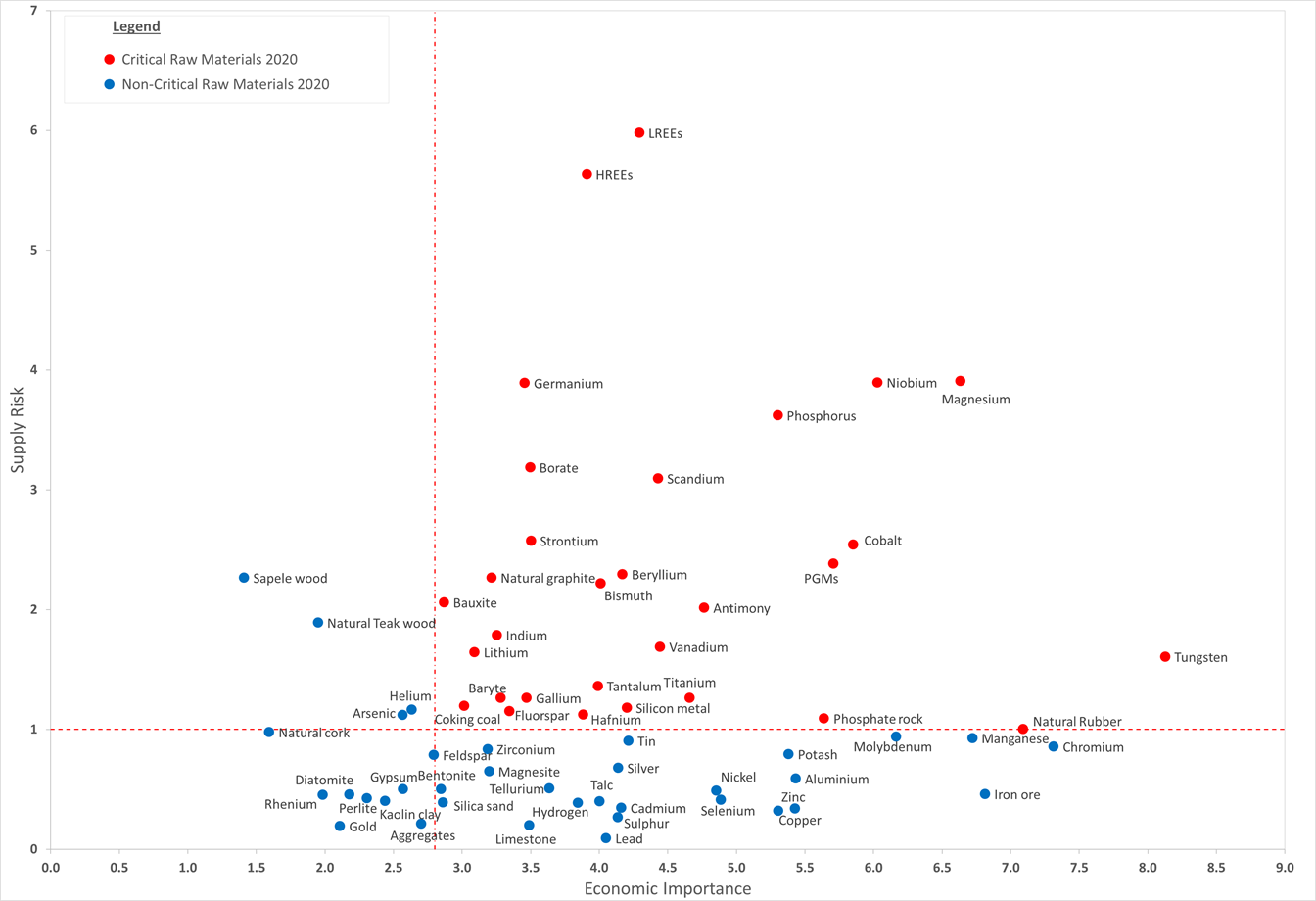

Since 2017, the methodology used for assessment of the criticality for candidate raw materials was modified and improved by the Commission (the Guidelines published have JRC and DG GROW as the main authors), looking at two main criteria: the economic importance and the supply risk. Economic importance is considering the share of the end use of a raw material in one sector, the share of the sector in total value added and the opportunity of substituting the raw materials provided by existing technology levels. Supply risk is computed based on concentration of supply, political instability of a supplier, import reliance and the balance between suppliers from European versus a global perspective.

The JRC proposes a Dashboard for Critical Raw Materials, reporting on the evolution of the assessment results for all candidate raw materials selected for criticality assessment. The Dashboard is showing the qualitative results for each year of assessment (starting 2011), evaluating also the existence of a potential trend for each of the two main criteria. The qualitative heat maps for both supply risk and economic importance criteria are derived from the quantitative results of assessment forming the base for selection of the EU List of CRM in the year of publication by the Commission (2011, 2014, 2017, 2020, 2023). For each criterion, there is a trend icon showing potential increase of criticality for selected raw materials.

The JRC will update every three years (following the publication of the Communication dedicated to the EU List of Critical Raw Materials) the CRM Dashboard, adding one more column to the heat maps for each selected raw material and each criterion, updating also the trend profile. JRC proposes to use the Dashboard as a possible future-oriented early warning tool in evaluating the criticality associated to raw materials.

| raw material | 2011 | 2014 | 2017 | 2020 | 2023 | trend |

|---|

| raw material | 2011 | 2014 | 2017 | 2020 | 2023 | trend |

|---|

Explanatory Note

The highest the supply risk is, the darkest is the nuance of color gradient red-purple of the respective heat map. The highest the economic importance, the darkest is the nuance of color gradient yellow-blue. Gray means that the correspondent (specific) raw material was not assessed for criticality in the respective year

An ascending trend “➚” means that, over the period 2011-2020, the values for the respective criterion and selected raw materials increased (higher supply risk or higher economic importance). A descending trend “➘” means the reduction in the values associated to the criterion. “∼” means uncertain trend and “➙” means stable/constant quantitative estimates throughout the period. Several raw materials do not show a trend as they were assessed only for one year.

An asterisk in the cell corresponding to a specific raw material and to a certain year means that the respective raw materials has been declared critical in that particular year, according to the Communication on the EU List of Critical raw Materials.

On mouse hovering each cell, a tooltip with the respective indicator's value will pop-up.

Info and Contacts

According to Commission’s site dedicated to Critical Raw Materials (DG GROW - https://ec.europa.eu/growth/sectors/raw-materials/specific-interest/critical_en): “raw materials are crucial to Europe’s economy. They form a strong industrial base, producing a broad range of goods and applications used in everyday life and modern technologies. Reliable and unhindered access to certain raw materials is a growing concern within the EU and across the globe. To address this challenge, the European Commission has created a list of critical raw materials (CRMs) for the EU, which is subject to a regular review and update. CRMs combine raw materials of high importance to the EU economy and of high risk associated with their supply.”