Titanium metal in the EU: Strategic relevance and circularity potential

-

The titanium metal supply chain

-

-

Titanium in strategic applications

-

-

The geopolitics of titanium metal

-

-

Titanium and the circular economy

-

-

Potential policy interventions

-

-

JRC publications (policy and academic)

-

Link to report: "Titanium metal in the EU: Strategic relevance and circularity potential"

The titanium metal supply chain

- The first stage of the titanium metal supply chain is mining, where titanium-containing minerals are extracted and processed to remove impurities, separating titanium dioxide (TiO₂) from other elements. Approximately 95% of TiO₂ is used in the manufacturing of whitening pigments, while only around 5% is allocated to titanium metal manufacturing.

- The process of converting titanium dioxide into titanium metal begins with the Kroll process, where TiO₂ is chlorinated to produce titanium tetrachloride (TiCl₄), which is then purified and reduced with magnesium under a vacuum or inert atmosphere. This yields titanium sponge, a porous form of pure titanium. A small portion of titanium sponge is used to make ferrotitanium, an alloy applied as a cleansing agent in steelmaking, while the rest is processed into titanium metal.

- In the next stage, titanium sponge and scrap feedstock are melted along with alloying elements to form cast shapes, commonly referred to as ingots or slabs, or turned into titanium alloy powder for use in additive manufacturing. These are then fabricated into generic mill products, including blooms, billets, bars, tubes, wires, plates, sheets and strips, through forging and rolling processes.

- These mill products or titanium powders are later converted into downstream titanium articles like forgings, castings and finished components.

- Secondary material flows play a crucial role in this value chain. Titanium scrap is generated at various production stages: new scrap, composed of machining waste and turnings, is produced during manufacturing, while old scrap arises from end-of-life products such as decommissioned aircraft parts. This scrap can be remelted with titanium sponge for ingot production, thereby reducing the need for primary materials

Global titanium production

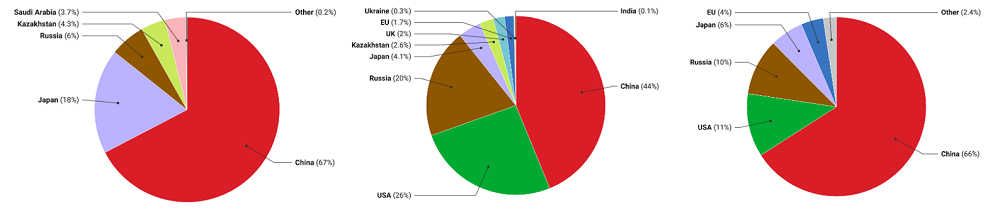

- In sponge, China’s dominant position has increased significantly over the past decade, accounting for roughly two thirds of global output by 2023. However, the majority of Chinese titanium sponge is not suitable for critical aerospace applications. High-quality sponge required for aerospace is produced in Japan, Russia, and Kazakhstan.

- In melted and wrought products, China also maintains a strong leadership. The EU has some capacity, but remains significantly behind other major players. As a result, the EU must import substantial quantities of sponge and semi-finished products to meet domestic demand.

Titanium in strategic applications

- Aerospace & Defence: Titanium is a critical material in the aerospace and defence industries due to its outstanding strength-to-weight ratio (density of about 60% that of steel and strength that exceeds carbon steel), thermal stability and superior corrosion resistance. It is extensively used in aircraft structures, engines, and military applications where components must withstand extreme temperatures, high stresses, and comply with rigorous safety standards.

- Industrial applications: Titanium is increasingly used in critical components of various industrial applications, such as equipment used in chemical processing, marine applications, power generation, desalination plants and the automotive industry. It is used in heat exchangers and condensers, tanks, reactors, piping systems, shipbuilding (hulls, propeller shafts, pumps, valves and other components), offshore equipment, nuclear power plants (e.g. waste storage), geothermal energy, automotive components (e.g. engine valves and exhaust systems), and desalination plants due to its excellent resistance to corrosion in harsh environments.

- Medical and healthcare: Titanium's excellent biocompatibility characteristics and durability make it ideal for medical applications, including implants and prosthetics (such as hip and knee replacements, dental implants), surgical instruments and medical devices (e.g. pacemakers, defibrillators).

- Architectural applications: Titanium is used in the field of construction for building facades (cladding and roofing materials) and structural elements in buildings and bridges due to its durability, corrosion resistance and aesthetic appeal.

- Consumer goods: Titanium is also used in consumer electronics (casings and components of smartphones, laptops and tablets), jewellery including watches and glasses frames, and high-end sports equipment (professional-level golf clubs or bicycle frames).

In the EU, aerospace is the largest consumer of titanium metal (67% of total demand), particularly for aircraft structures; as a result, titanium demand remains heavily linked to aerospace activity. The defence sector relies on titanium for aircraft, armoured vehicles, submarines and missile systems. Industrial use of titanium spans from chemical processing to marine environments. Emerging applications in additive manufacturing (AM) present significant opportunities to enhance material efficiency, mitigate supply risks, and improve titanium’s circularity.

The geopolitics of titanium metal

Overview and main dependencies

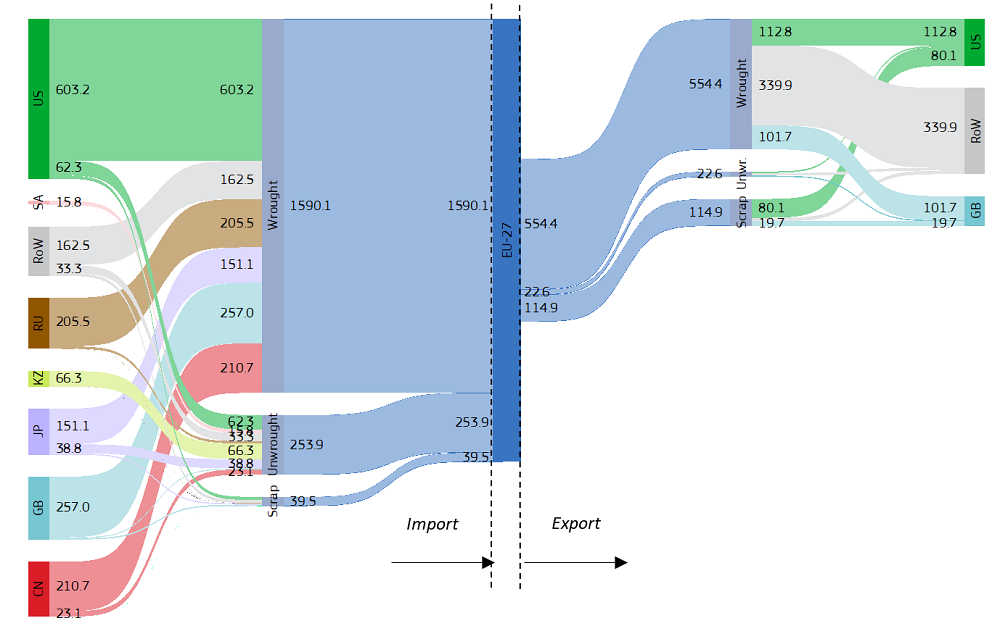

- For unwrought products, Japan dominates the global picture due to its dominance in sponge production. The EU is a net importer, yet it exports powders for additive manufacturing. The Rest of the World, driven by Kazakhstan and Saudi Arabia, ships sponge to the EU, the US, South Korea and China. Chinese exports are negligible compared to its massive sponge production as most Chinese output is consumed domestically

- The trade in other titanium products, which include more specialised or processed forms of titanium (wrought and titanium articles), shows the EU, South Korea and the Rest of the World block as net importers,

- In titanium waste and scrap, the most notable feature is how the US receives scrap from the rest of the world. The EU is a net exporter of scrap, shipping most of it to the US and the UK.

The EU position

- The EU is a net importer of titanium metal, with an overall import-to-export ratio of 10:1 for unwrought products and 6:1 (3:1 by value) for wrought products. Wrought products represent the largest share of the EU's imports.

- Buyback agreements constitute a significant obstacle to circularity in the EU. Titanium producers in third countries offer discounted primary titanium in exchange for returning the scrap after manufacturing parts in the EU. Besides, the lack of titanium production capacity makes recycling scrap within the EU less economically viable

Major players in titanium metal

- The United States have been the EU’s most important trading partner for wrought titanium products and scrap. Due to the current geopolitical pressures linked to the Russian war in Ukraine, the US is likely to remain the most important source of wrought titanium imports to Europe.

- China has the largest titanium ore resources in the world. It is also the biggest producer of titanium metal outputs globally. The high costs and subprime quality of Chinese titanium remain major obstacles for expanding the supply chain for aeronautical applications to China.

- Russia has become a major supplier of titanium for the aeronautical sector, while also heavily reliant on imported titanium sponge.

- Kazakhstan has partnered with consumers in Europe and Asia, boosting sponge production and sustaining it effectively. The Russian aggression on Ukraine conflict has redirected most Kazakh exports to the EU, the US, and South Korea.

- Ukraine has worked to regain control over the titanium industry after an extended period of Russian control. The EU stands as the primary partner for Ukrainian titanium exports. Export volumes have drastically declined following the Russian invasion.

The Russian aggression on Ukraine and its effects

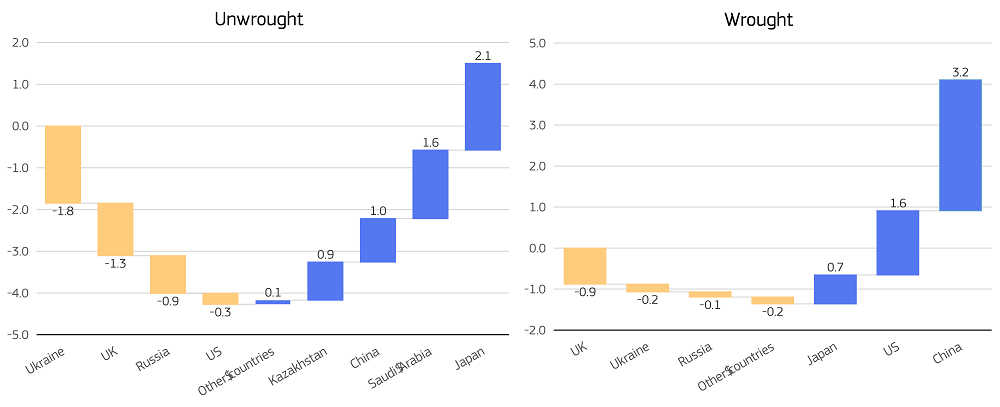

- High inventories and lower demand have mitigated impacts of the Russian aggression on Ukraine. In addition, spare capacity in Japan, Kazakhstan and the US, as well as the expanding capacity in China and Saudi Arabia, has filled supply gaps for sponge and ingots. However, Russia's influence in the global aerospace industry is substantial. The risk of a global titanium supply chain crisis is further aggravated by the expected rise in demand from the aerospace and defence industry in the coming years, and the few producers worldwide.

- The EU has completely made up for the losses of Russian and Ukrainian supply of unwrought titanium products (sponge, ingots and powders), as well as managed the additional demand for imports. Regarding wrought products, increased imports from China, the United States and Japan have met the higher domestic needs in the EU.

Titanium and the circular economy

R&I in titanium circularity

The geographical distribution of academic publications on titanium metal circularity reveals that Europe and China are leading regions. Western Europe and Central Asia exhibit the strongest collaboration with the EU, which also maintains a notable presence in Central and South America.

Patents present a different structure: the US leads by a significant margin, followed by Japan and the EU; despite its lack of titanium production capacity, the EU shows substantial patenting activity, reflecting efforts to establish circularity solutions and reducing import dependencies.

Circularity scenario modelling

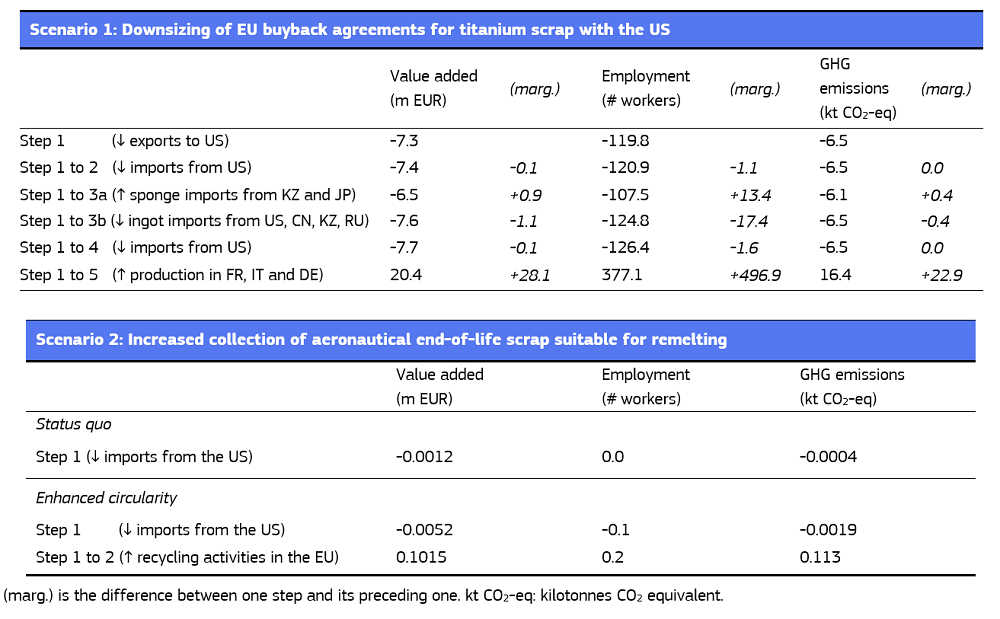

- Disaggregating trade flows using customs data, two enhanced circularity scenarios for the EU are constructed, and their macroeconomic and environmental effects are assessed.

- In the first scenario, the EU retains aeronautical manufacturing scrap that is currently returned under buyback agreements, which will be used to produce new aeronautical ingot and finished titanium products domestically. The EU economy could gain 377 jobs within the titanium supply chain, and EUR 20 million in total output. This is equivalent to doubling employment in the EU titanium sector, and increasing value added by the equivalent to the total assets of a medium-sized titanium factory.

- In the second scenario, we estimate the amount of scrap that could be recovered from decommissioned commercial aircraft at their end of life, and remelted into ingots. This scenario indicates only a marginal sectoral gain, with the current infrastructure sufficient to manage the increased flow.

Potential policy interventions

- Reshoring the midstream titanium industry in the EU, together with fostering recycling capabilities, is critical for strategic autonomy. However, high energy costs, the lack of access to scrap, and competition from vertically integrated foreign firms constitute major challenges. Policies to lower energy costs, incentivize public-private investments, and adopt emerging technologies could reduce energy use and emissions. Transitioning to a cleaner energy mix and leveraging circularity could align reshoring with decarbonization goals, enhancing competitiveness and supporting EU industrial and environmental priorities.

- To enable domestic titanium recycling, the EU must secure high-quality production scrap, which is hindered by buyback agreements with the US. Phasing out such agreements requires simultaneous development of the EU titanium industry and collaborative trade talks to avoid trade tensions. Partnering with US firms on EU recycling infrastructure and accessing advanced American technologies could foster mutual benefits and strengthen the EU’s titanium supply chain resilience.

- Ukraine’s high-quality titanium deposits present opportunities for EU value chain integration, but the ongoing war has disrupted production facilities and created uncertainty. Past efforts, including strategic EU-Ukraine partnerships, suggest potential for collaboration post-conflict. Revamping Ukraine’s processing facilities, aligning them with EU environmental standards, and navigating internal debates on privatisation versus state control will be key. Post-war reconstruction provides an opportunity for the EU to support Ukraine’s titanium industry, ensuring strategic supply while countering geopolitical risks.

- The EU must diversify titanium sponge sourcing by expanding partnerships with countries like Kazakhstan, Japan, and Saudi Arabia. Collaborations under the Global Gateway and Mineral Security Partnership Forum could secure resilient supplies while greening global value chains. Investing in sustainable technologies in extraction countries can reduce environmental impacts. Joint ventures for technological upgrading can enhance resource efficiency and competitiveness, supporting EU industrial decarbonization goals.

- End-of-life recycling of titanium in the aeronautical sector is hindered by profitability issues, technical challenges, and stringent regulatory requirements. Policies promoting eco-design could encourage easier recovery of titanium from airframes and engines. Greater transparency in material composition and revised recertification systems could unlock greater circularity. Incentives to retain end-of-life (EoL) scrap domestically could ensure economic, environmental, and strategic benefits for the EU titanium industry.

JRC publications (policy and academic)

This report gathers information from several JRC publications in the form of policy documents or academic articles:

- Baldassarre, B., Buesa, A., Albizzati, P., Jakimów, M., Saveyn, H. and Carrara, S. (2023). “Analysis of Circular Economy Research and Innovation (R&I) intensity for critical products in the supply chains of strategic technologies”, JRC Science for Policy Report, JRC134253.[ link ]

- Baldassarre, B. (2024). “Circular economy for resource security in the European Union (EU): Case study, research framework, and future directions”. Ecological Economics 227: p. 108345. [ link ]

- Buesa, A., P. Albizzati, E. Garbarino, H. Saveyn and Baldassarre, B. (2023). “Circular economy in EU critical value chains: The case of titanium metal in defence and civil aviation”. In K. Niinimäki, K. Cura (Eds.), Product Lifetimes and the Environment 2023, Aalto University Publication Series, pp. 149-154. [ link ]

- Buesa, A., Pedauga, L., Piñero, P., Rueda-Cantuche, J.M., and Baldassarre, B. (under review, 2024). “The benefits of enhanced circularity for strategic autonomy: Titanium metal in the EU”.Submitted to Resources Policy. [Earlier version published as “Can circularity in titanium metal improve EU strategic autonomy? Scenario modelling with heterogeneous data”, JRC Working Papers in Economics and Finance 2024/06, JRC139576.] [ link ]

- Carrara, S., Bobba, S., Blagoeva, D., Alves Dias, P., Cavalli, A., Georgitzikis, K., Grohol, M., Itul, A., Kuzov, T., Latunussa, C., Lyons, L., Malano, G., Maury, T., Prior Arce, A., Somers, J., Telsnig, T., Veeh, C., Wittmer, D., Black, C., Pennington, D. and Christou, M. (2023). “Supply chain analysis and material demand forecast in strategic technologies and sectors in the EU – A foresight study”, JRC132889.[ link ]

- Georgitzikis, K., D’Elia, E. and Eynard, U. (2022). “Titanium metal: Impact assessment for supply security”, JRC129594.[ link ]

- Jakimów, M., Samokhvalov, V. and Baldassarre, B. (2023). “Achieving European Union strategic autonomy: circularity in critical raw materials value chains”. International Affairs 100 (4): pp. 1735-1748. [ link ]