Lithium-based batteries supply chain challenges

Batteries: global demand, supply, and foresight

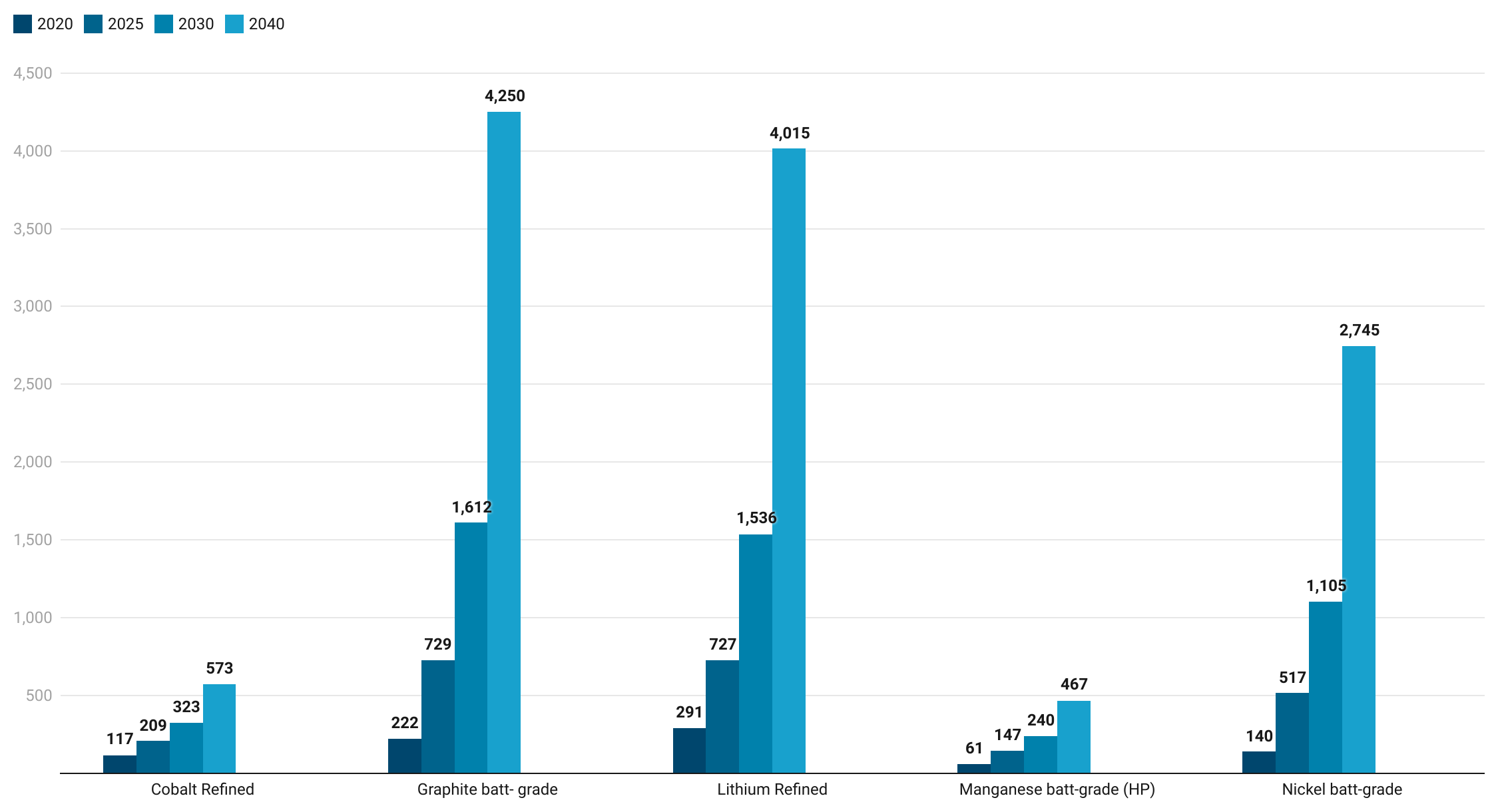

- The global demand for raw materials for batteries such as nickel, graphite and lithium is projected to increase in 2040 by 20, 19 and 14 times, respectively, compared to 2020.

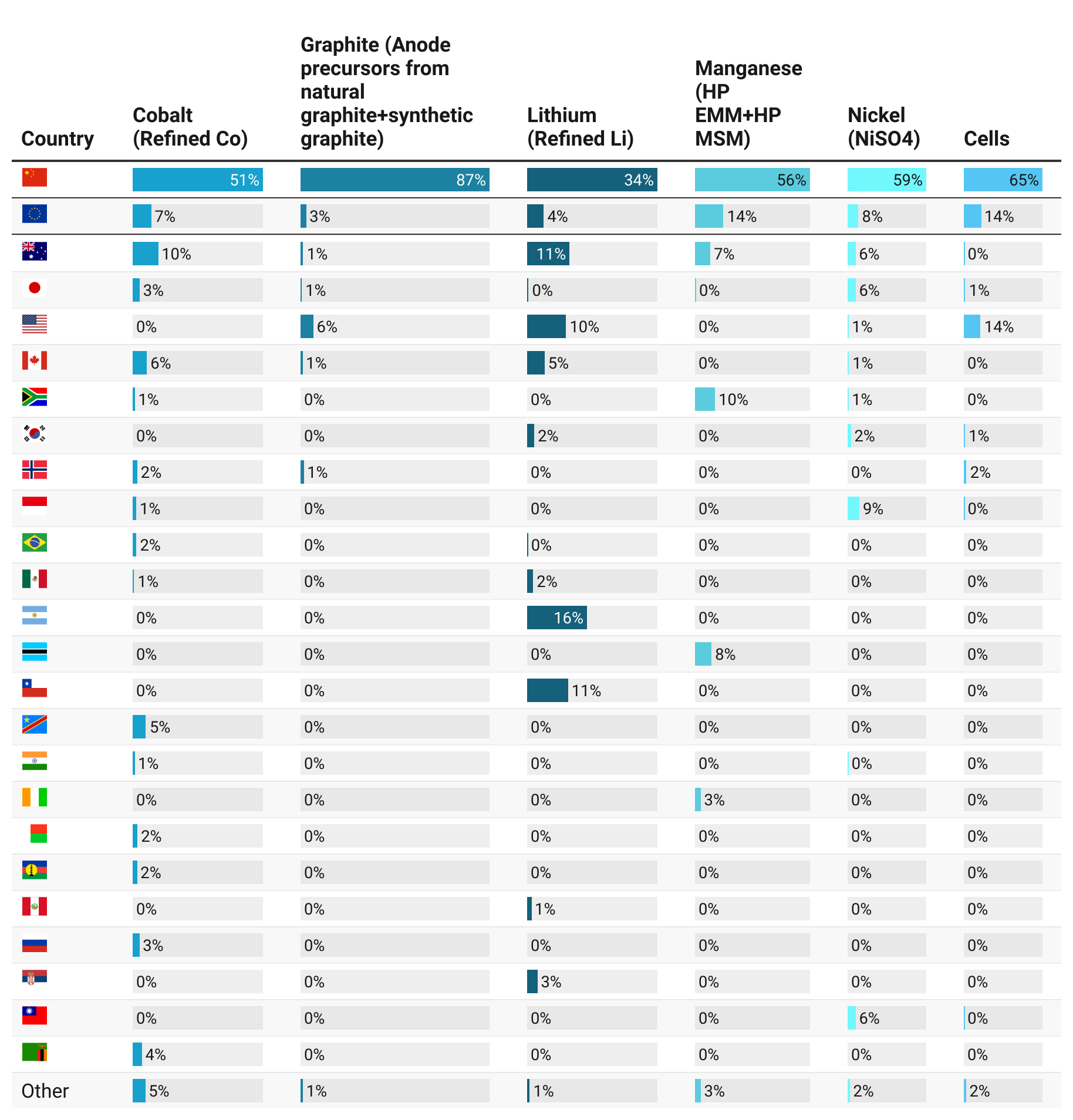

- China will continue to be the major supplier of battery-grade raw materials over 2030, even though global supply of these materials will be increasingly diversified.

- Possible supply shortages will remain. In the short to medium-term, deficits are expected for lithium in 2022-2023, whereas the global supply/demand market balance will be tight for nickel (by 2029), graphite (by 2024) and manganese (by 2025).

- By 2025, the EU domestic production of battery cells is expected to cover EU’s consumption needs for electric vehicles and energy storage. However, it is likely that the EU will be import reliant to various degrees for primary and processed (batt-grade) materials.

- Australia and Canada are the two countries with the greatest potential to provide additional and low-risk supply to the EU for almost all battery raw materials.

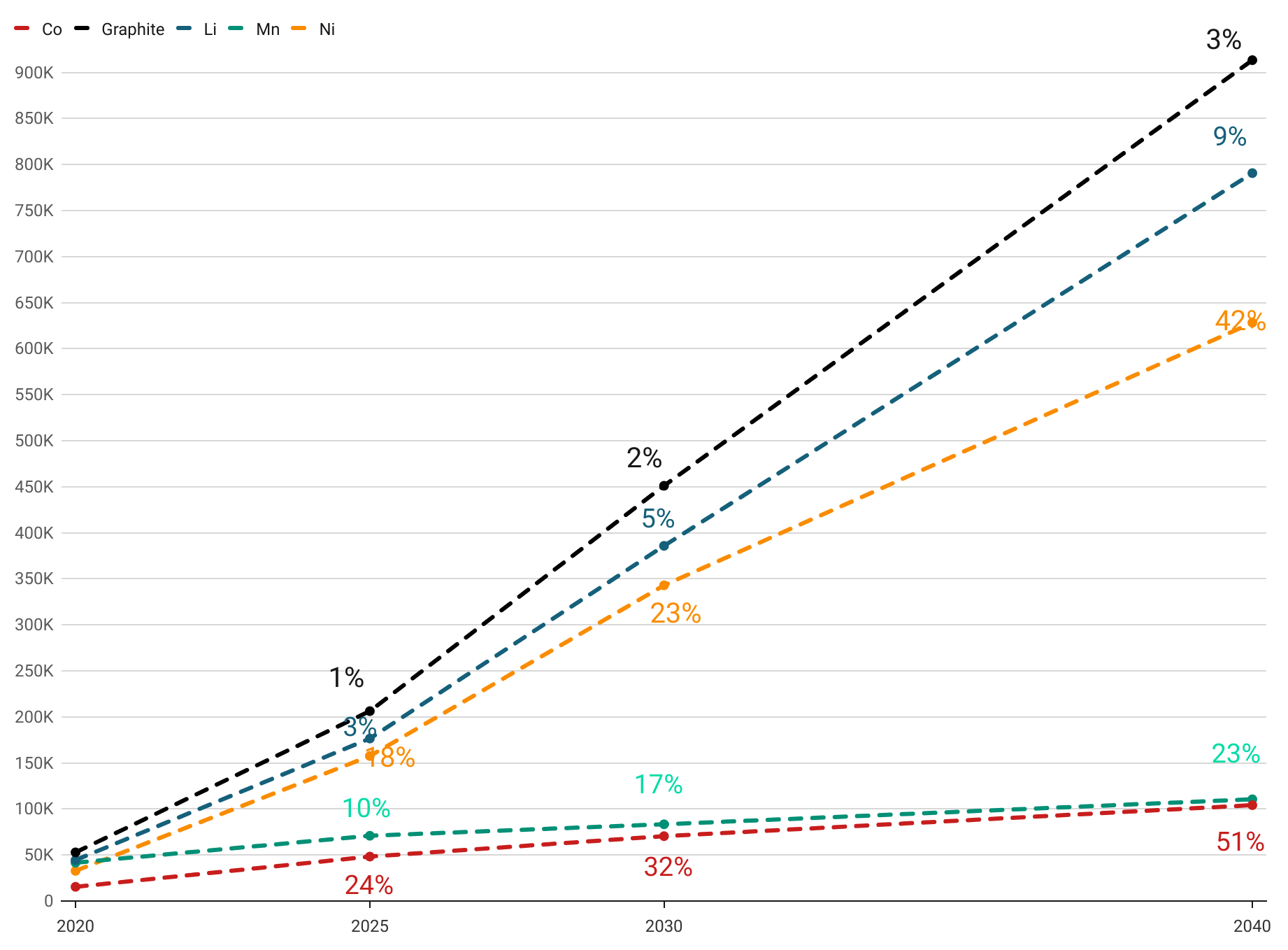

- Enhancing circularity along the battery value chains has potential to decrease EU’s supply dependency. It is estimated that by 2040 recycling could contribute to up to 51% and 42% of Cobalt and Nickel EU demand, respectively.

Demand

Demand1 for battery raw materials is expected to increase dramatically over 2040 (Figure 1), following the exponential growth of electric vehicles (EV) and, to a minor degree, energy storage system (ESS) applications. The largest increase2 in the medium (2030) and long term (2040) is anticipated [1] for graphite, lithium and nickel (e.g. lithium demand for batteries is foreseen to grow fivefold in 2030 and have a 14-fold rise in 2040 compared to the 2020 level).

Supply

The supply1 of each processed raw material and components for batteries is currently controlled by an oligopoly industry, which is highly concentrated in China. Although China is expected to continue holding a dominant position, geographic diversification will increase on the supply side, mostly for refined lithium. However, the supply concentration globally is projected to remain extremely high for graphite and significant for mined cobalt, battery-grade nickel and manganese.

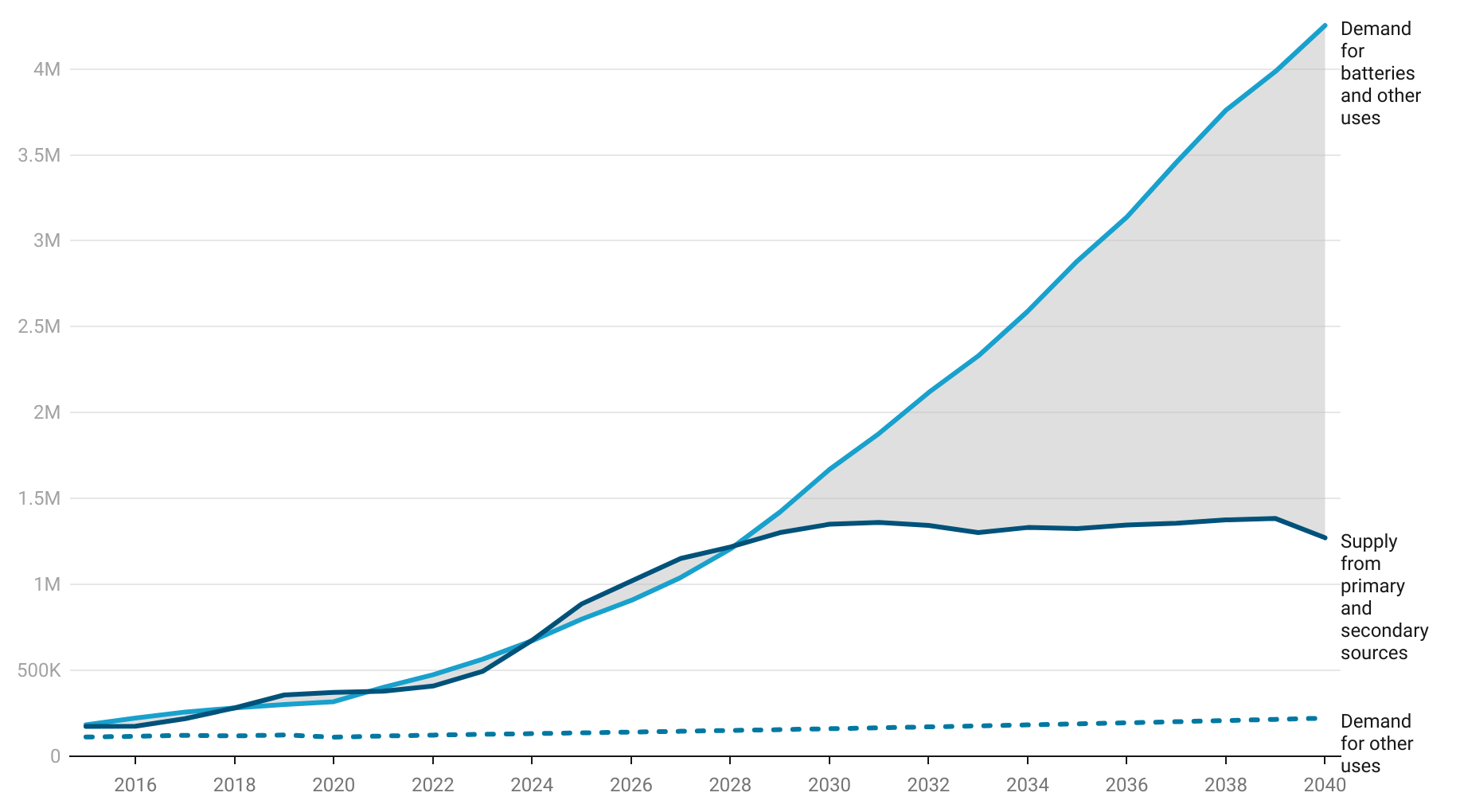

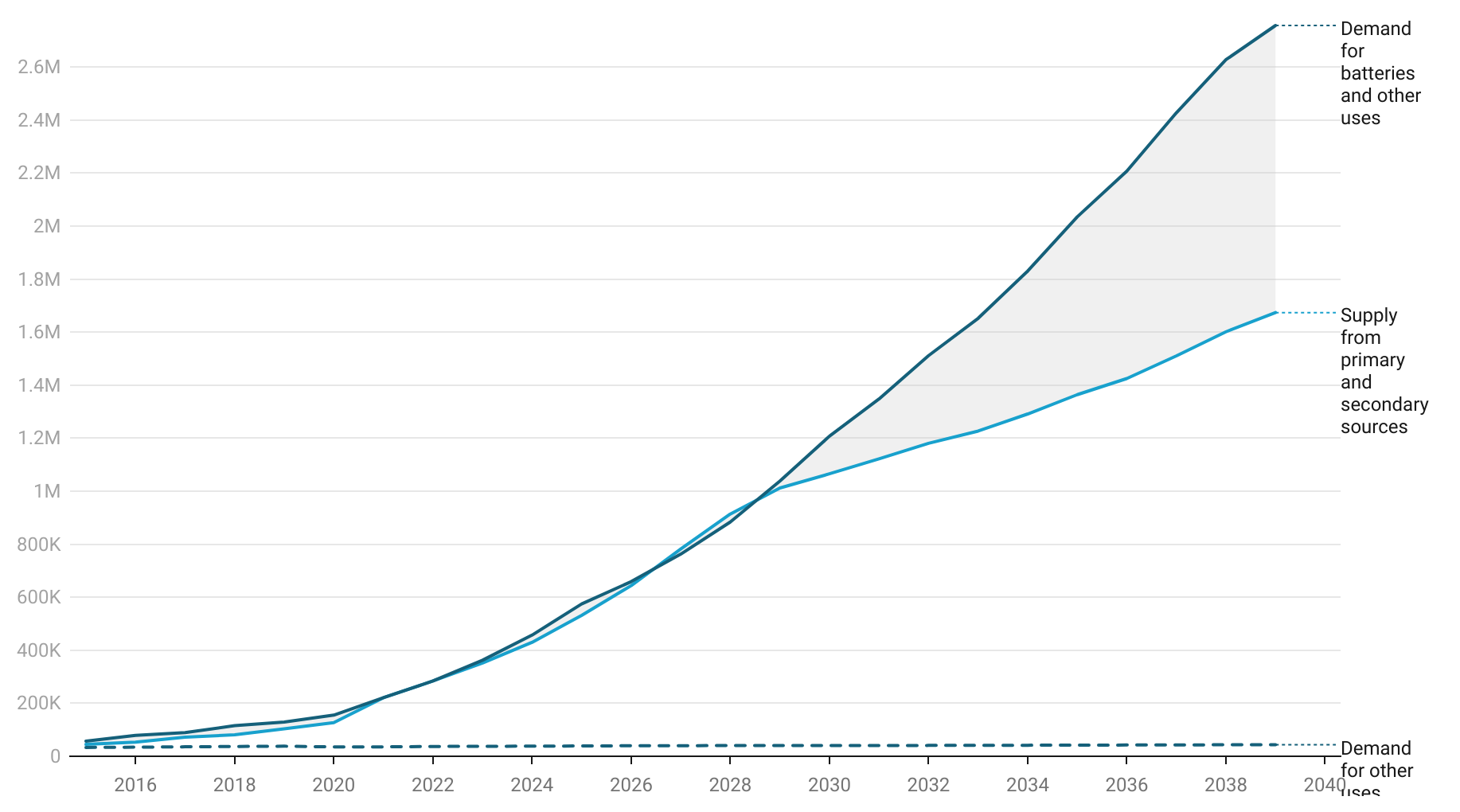

Deficits in the short term are expected for lithium in 2022-2023 (Figure 2). Shortages are also probable for graphite, manganese and nickel supply as the global market balance will remain very tight between now and 2024 for graphite, until 2025 for manganese and up to the end of the decade for nickel.

Demand will outstrip supply3 for all raw materials beyond 2029-2030 (with the exception of graphite due to massive expansion of synthetic graphite capacity in China) unless new investments timely provide the supply required by the rapid growth of demand.

The lithium and nickel market balances for battery-grade products raise concern for raw material availability in 2030-2040, due to lithium’s explosive demand growth and nickel’s slower development on the supply side.

EU production and diversification of supply

Total battery consumption in the EU will almost reach 400 GWh in 2025 (and 4 times more in 2040), driven by use in e-mobility (about 60% of the total capacity in 2025, and 80% in 2040).

The EU is expected to expand its production base for battery raw materials and components over 2022-2030, and improve its current position and global share. However, dependencies and bottlenecks in the supply chain will remain creating vulnerabilities.

The EU will continue to be dependent on imports of cobalt and nickel (concentrates and intermediates) for conversion in its refineries. Conversely, most inputs for producing refined lithium compounds will originate from the development of new lithium mines in the EU.

The refining of natural graphite for anodes will rely on both domestic production and imports. Concerning manganese, the EU is likely to be self-sufficient in both primary and refined raw materials.

The structure of global supply in the coming years (Figure 3) provides an initial insight into potential EU import sources. Nevertheless, a deeper analysis is required to forecast quantitatively the export availability worldwide and reveal potential competition with other importing countries, after taking into account parameters such as captive production, long-term offtake agreements, intermediate products and ownership of producing companies.

Australia and Canada are the two countries with the greatest potential to provide additional and low-risk supply to the EU. Other producers that could reduce the EU’s supply risks substantially are Argentina and Chile for lithium chemicals, Mozambique and Tanzania for natural graphite and the USA for refined graphite. In Europe, Serbia is a likely source of lithium minerals for conversion to chemicals, and Norway a reliable source of flake and refined graphite.

Enhancing the circularity of the value chain

Demand of primary materials for batteries can be decreased as well as the criticality of raw materials supply through the adoption of various Circular Economy (CE) strategies, e.g. extending the lifespan of batteries (reuse, remanufacturing and second-use) and recycling (providing secondary materials). The Batteries Regulation [2], in particular, is likely to play an important role in the next decades due to new targets4 related to collection, recycled content and recycling efficiency. Figure 4 illustrates the potential contribution of recycling in recirculating secondary materials to the materials demand.

Key aspects to increase quantities/volumes of secondary raw materials, to maximize circularity and to increase environmental benefits in the EU include ‘design for circularity', traceability of batteries along their value-chain, development of business cases related to CE strategies, maximisation of waste batteries collection and development of high-quality recycling technologies. To estimate and monitor the contribution of different CE strategies quantitatively, further modelling is needed, especially due to rapid technological evolution and the expected creation of new business cases related to such strategies.

REFERENCES

[1] The JRC battery raw materials and value chain tool (2021) and ongoing RMIS modelling work. (Latest supply data update: Cobalt Sep 21, Graphite Nov 21, Lithium Sep 21, Manganese June 21, Nickel Sep 20, Anodes Sep 21, Cathodes Jan 22, Cells Jan 22, Recycling Oct 21. Latest demand data update: Oct 21), https://rmis.jrc.ec.europa.eu/.

[2] COM(2020) 798 final, “Regulation of the European parliament and of the council concerning batteries and waste batteries".

[1] Demand and supply data are based on JRC modelling [1], except for primary supply of Ni, for which data from Roskill’s study for JRC is used.

[2] Unless otherwise indicated, supply and demand indicators are expressed in metal content for raw materials (except lithium, for which LCE is used), in tonnes for anodes and cathodes, and in GWh for cells.

[3] The level of supply after 2030 is uncertain as new projects currently at an early stage of development do not have adequate documentation.

[4] The Batteries Regulation proposal defines novel recycled content targets for cobalt, lithium and nickel (Article 8), ambitious targets for both collection of waste batteries (articles 48 and 49) and recycling targets per different materials (Article 57).