Climate change and decarbonisation

Decarbonisation is one of the main goals of the European Green Deal, with the ambition to have a carbon-neutral Europe by 2050. This goes in line with the Paris Agreement, which sets out a global action plan to limit global warming to well below 2 °C, aiming to limit the increase to 1.5 °C, and to work towards climate neutrality before the end of the century. The EU should by 2050 be among the first to achieve net-zero GHG emissions leading the way worldwide. Goal 13 of the Sustainable Development Goals calls on countries to take urgent action to combat climate change and its impacts.

The EU is already taking action: the 2030 climate and energy policy framework contains a binding target to cut emissions in EU territory by at least 40 % below 1990 levels by 2030, and the 2050 low-carbon economy roadmap announces 80 % cuts by 2050, also compared to 1990 levels.

In this context, the raw materials industries can both contribute to global warming, and at the same time provide the materials that are being used and will be required for the deployment of low-carbon technologies. Furthermore, climate change itself is expected to have an impact on the secure supply of raw materials.

This section consists of several sub-sections covering all these aspects. In addition, a dedicated sub-section describes the datasets available on greenhouse gas (GHG) emissions.

GHG are generated throughout the raw materials value chain, by processes such as drilling, ventilation, beneficiation, manufacturing, transport and waste management. While for some materials emissions concentrate in the extraction stages, for other materials emissions during processing are higher.

Emissions can be direct, i.e. they are emitted on site at producing facilities, or indirect, i.e. they are emitted elsewhere. Most direct emissions originate from the use of energy or fuels for mechanical processes (e.g. drilling) or for the production of heat. In fact, the raw materials sector is generally considered energy-intensive. In addition, so-called ‘process-emissions’ derive from some industrial processes where chemical reactions release carbon, e.g. calcination of limestone to yield cement, or metallurgical furnaces.

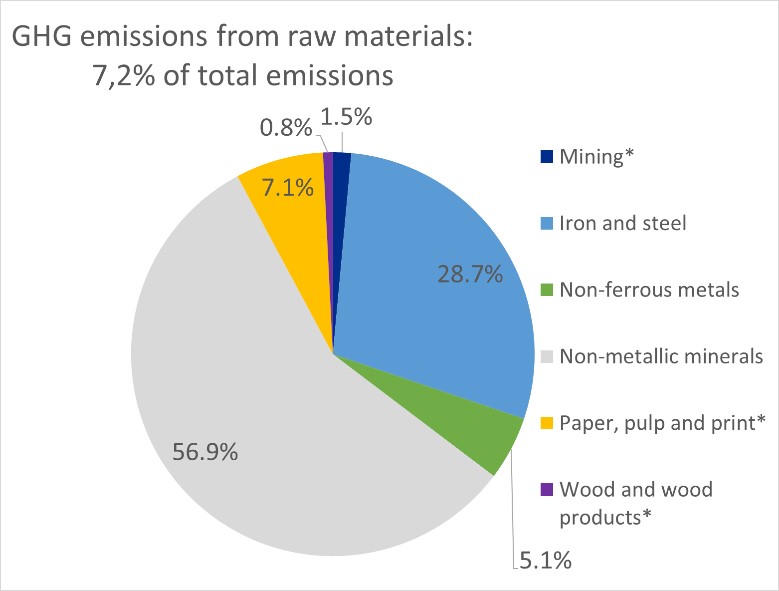

Direct GHG emissions generated onsite by EU raw materials industrial facilities account for 7.2% of all direct GHG emissions in the EU (2015). Most of the direct emissions from these industries, which are generally considered energy-intensive, originate from the use of energy. However, some industrial processes, such as calcination for cement production or metallurgical furnaces in metals production, also release significant amounts of GHGs. Overall, the biggest contributors to GHG emissions are the production of non-metallic minerals and of iron and steel (Figure 2). Yet values change across Member States.

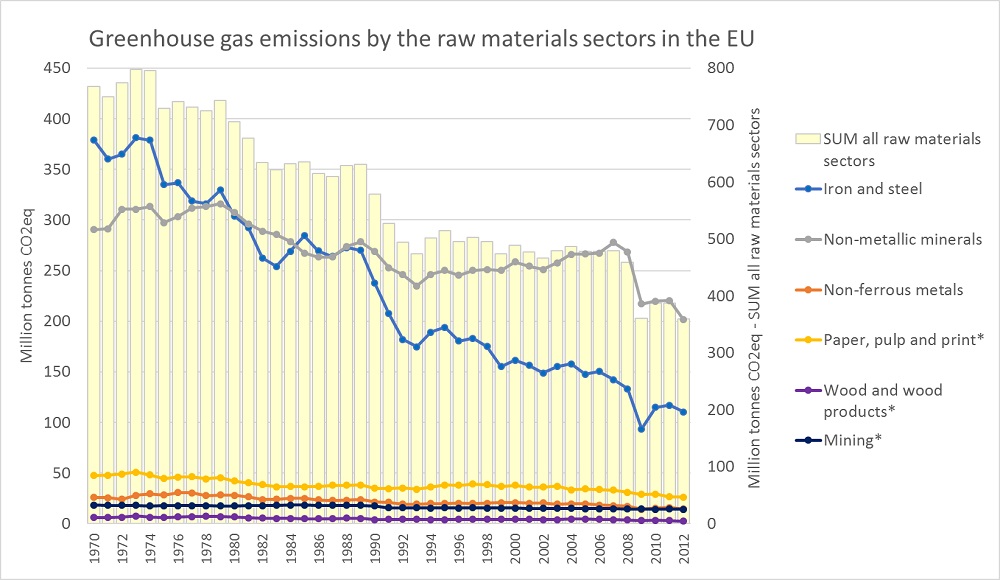

Direct GHG emissions from the raw materials sector in the EU have decreased over the past decades (Figure 3). This has been due to the shift of production to other countries and to efficiency improvements, particularly related to changes in the fuel mix (e.g. moving from the use of coal to gas or renewable sources). Efficiency improvements have been also linked to technological enhancements in production processes, such as the introduction of direct reduction in iron and steel-making. Emission trends also follow fluctuations in production volumes due to changes in demand, such as the decrease experienced during the financial crisis.

Zooming into the trends in the different EU raw materials sectors, iron and steel production showed the largest absolute decrease in the last 15 years (59 thousand tonnes of CO2 equivalent, almost 39% reduction), followed by the production of non-metallic minerals (57 thousand tonnes, -24%), non-ferrous metals production (17 thousand tonnes, -50.8%), paper production (11.6 thousand tonnes, -34%), wood products (1.6 thousand tonnes, -38.4%) and mineral mining (864 tonnes, -15.4%) (Figure 3). The contribution from different Member States is very heterogeneous.

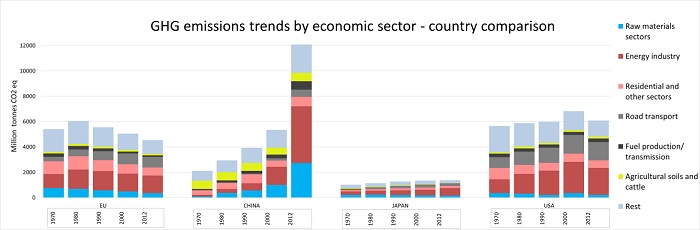

In contrast to the EU trends, GHG emissions from the raw materials sector have seen a remarkable increase at the global level (Figure 4). This increase has mostly been driven by the expansion of industrial production in developing economies such as China. The consumption of materials in both developed and developing countries has been a key driver for this expansion of the sector.

In addition to direct GHG emissions from EU industries, other GHG emissions are embodied in the raw materials production chain. For instance, emissions associated with the production of the electricity, fuels, chemicals, equipment, etc. that are used at raw materials production facilities; or the emissions during the transportation of materials (processed minerals, secondary materials, etc.), which may even be sourced from distant countries.

In addition, the way in which industrial waste is managed, the lifetime of products and the way in which products are managed when they reach their end of life, influence the total GHG emissions along the raw materials supply chain. Once a product reaches its end of life, it may be reused, recycled, used for materials/energy recovery or disposed of, which will result in different GHG balances. For instance, increasing the use of recycled materials as input to production has been proven to significantly reduce GHG emissions in the production of metals such as steel or aluminium (Deloitte, 2016).

The use of specific raw materials in final products can also have a strong impact on the emissions performance of the product, i.e. the amount of emissions generated during the use phase. For instance, the use of light materials such as aluminium in vehicles can in some cases considerably lower energy requirements during use of the product. Extending the use of a household product (e.g. a washing machine) by a few years could do more to reduce life cycle GHG emissions than immediately replacing the product with one in a higher energy class (JRC, 2014).

Finally, the sector can also have indirect impacts on global warming. For instance, the removal by extractive activities of forest areas that function as carbon sinks can play a significant role in the GHG balance; excessive deep-sea drilling can negatively affect the GHG mitigation capacity of the oceans, due to disturbances in the sea floor which may release the stored carbon.

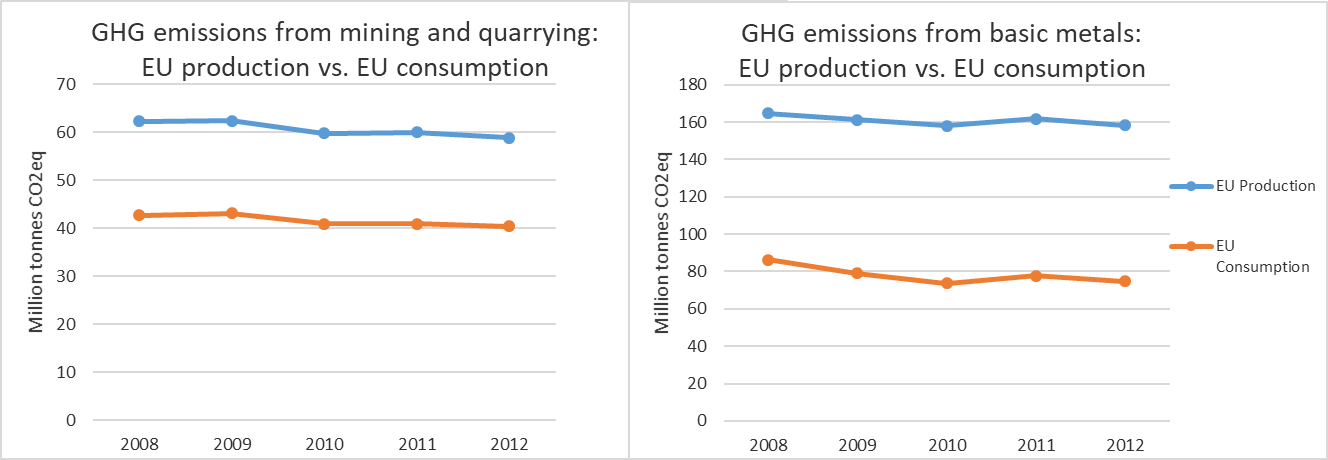

The final consumption of goods by EU industries and households is a major driver of GHG emissions, both within and outside the EU. While GHG emissions from EU domestic production of raw materials have decreased in recent years, emissions linked to EU consumption of raw materials products (which covers production and imports) have remained relatively stable (Figure 5). GHG emissions associated to consumption are a challenge to global GHG mitigation.

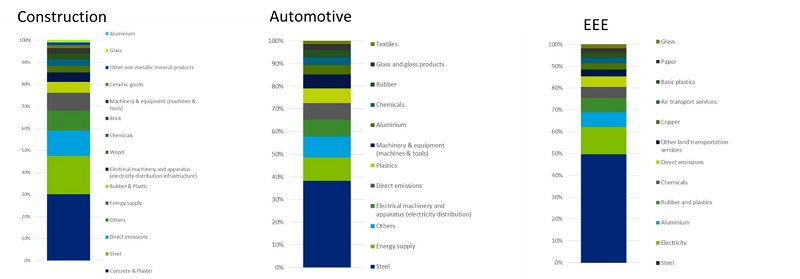

To develop targeted actions for climate mitigation in relation to raw materials, it is useful to understand which types of final products are responsible for most GHG emissions along the production chain, and how much of the total emissions are associated with raw materials production. For instance, raw materials-related GHG emissions represent a significant share of emissions generated by the energy, construction, automotive, and electrical and electronic equipment (EEE) sectors, considering emissions throughout the production chain. The production of concrete, plaster and steel accounts for a significant share of emissions from construction; steel, aluminium and rubber production are significant contributors to emissions from the automotive sector and from the manufacture of EEE (Figure 6).

Eurostat provides GHG emissions data by source sector, compiled by the European Environment Agency, in accordance with the United Nations Framework Convention on Climate Change (UNFCCC). These data give insights into GHG emission trends in the raw materials industries over recent decades. Furthermore, Eurostat Air Emission Accounts (AEA) provide GHG emissions data by NACE sector (from the year 2007/2008). While UNFCCC emissions data are based on a territorial principle, AEA follow the residence principle for national accounts: emissions are included even if they take place outside the EU territory, if the residence of the activity falls within the EU (for instance a shipping company operating abroad). Based on the AEA, Eurostat also estimates GHG emission intensities.

Scientific databases such as EDGAR provide GHG emission times series starting from the year 1970, using reference data sources for emission factors and activity data. Emission factors are average emission rate of a given GHG for a given source, relative to units of activity. Activity data gauges the magnitude of human activity resulting in emissions or removals taking place during a given period of time (e.g. fuel consumption, production volume).

These data sources report on GHG emissions linked to direct onsite production in industrial facilities, but do not consider emissions from energy generation taking place off site, from production of auxiliary inputs, or from transport and delivery of products. Based on the AEA and input/output tables modelling, Eurostat also estimates GHG emissions from the final use of products (EU total aggregate only), i.e. GHG emissions embodied in products for final use - also referred to as carbon footprint, which accounts for GHGs emitted by sector along the full production chain of products that are consumed within the EU.

In addition, private companies also disclose climate-related data, although reporting schemes and studies are still highly heterogeneous. Examples include the Global Reporting Initiative, where companies are asked to report direct emissions, emissions derived from energy use, emissions intensity and emissions reductions. Also the Climate Disclosure Project, to which companies report emission savings and saving targets. Both reporting initiatives cover also raw materials production companies.

Recently, several studies have been completed or are ongoing to explore possible mitigation paths for energy-intensive industries. In particular, the in-depth analysis to the Communication ‘A clean planet for all’ gives an overview of the recent trends in sectors such as iron and steel, non-metallic minerals and chemical, and explores several mitigation scenarios. Also, a set of energy-intensive industries, covering steel, cement, ceramics, paper, glass, and non-ferrous metals, have contributed to a study presenting GHG mitigation paths. The study presents their mitigation potential, as well as the technological implications and costs of the mitigation actions.

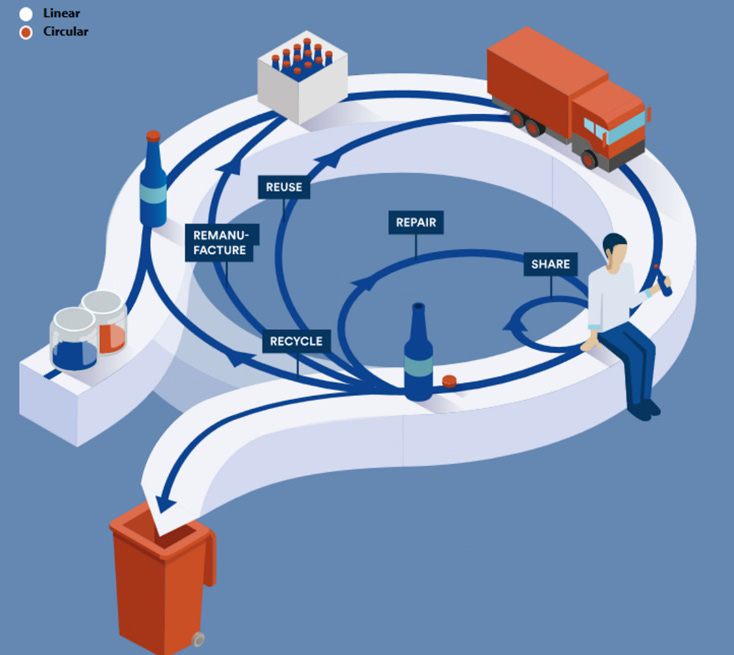

Some of the measures towards mitigation involve moving from a linear to a circular economy (Figure 6). The circular economy promotes resource efficiency, recycling and enhanced waste management, and may offer considerable mitigation potential. The circular economy may boost repair, reuse and recycling, which generally (although not always) save GHG emissions. It may also boost activities such as refurbishment (a product’s manufacturer updates the product’s appearance to expand the product’s life), remanufacturing (the manufacturer uses parts of an old product in a new product), and ecodesign (more efficient products with longer life and easier to recycle). Mitigation measures should also target the resource consumption patterns of households, e.g. the promotion of public and shared mobility systems can also significantly contribute to climate mitigation.

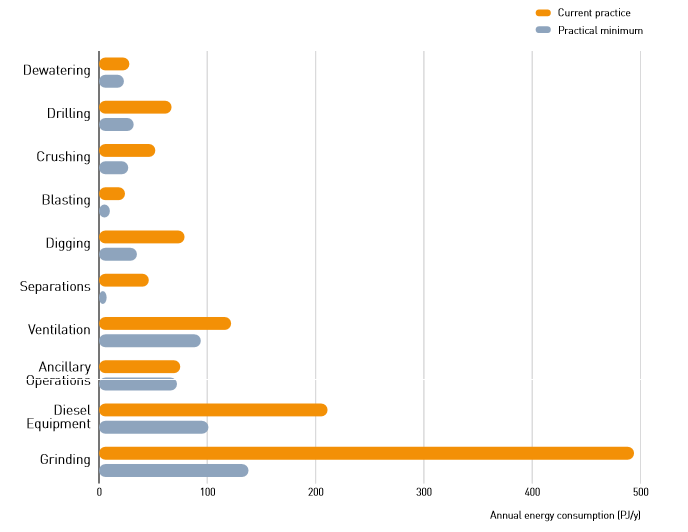

There are many energy efficiency opportunities in the mining and mineral processing sector (Figure 8). However, the decreasing trends in ore grade observed over recent years are a challenge to the mitigation potential in the mining sector, since decreasing ore grades generally lead to additional processing requirements and associated energy use.

Increasing recycling, reuse and repair in manufacturing sectors could also contribute to mitigation (Deloitte, 2016). For instance, increasing the use of recycled materials (secondary materials) as input to production can be a significant saver of GHG emissions in the consumption of metals such as steel and aluminium, but also many others (Table 1).

|

Metal/Product |

% Savings |

References |

|

Aluminium |

90 – 97 |

Norgate & Rankin (2002), Gaballah and Kanari (2001), Quinkert et al. (2001), International Aluminium Institute (2011), Chapman and Roberts (1983) |

|

Copper |

84 – 88 |

Norgate and Rankin (2002), Gaballah and Kanari (2001) |

|

Gold |

98 |

Ecoinvent v2.2 |

|

Lead |

55 – 65 |

Norgate and Rankin (2002), Gaballah and Kanari (2001 |

|

Magnesium |

97 |

USEPA (1994) |

|

Nickel |

90 |

Norgate and Rankin (2002) |

|

Palladium |

92 – 98 |

Ecoinvent v2.2 |

|

Platinum |

95 |

Ecoinvent v2.2 |

|

Rhodium |

98 |

Ecoinvent v2.2 |

|

Silver |

96 |

Ecoinvent v2.2 |

|

Steel |

60 – 75 |

Norgate and Rankin (2002), Gaballah and Kanari (2001) |

|

Stainless Steel (304) |

68 |

Johnson et al. (2008), Eckelman (2010) |

|

Titanium |

67 |

Chapman and Roberts (1983) |

|

Zinc |

60 – 75 |

Norgate and Rankin (2002), Gaballah and Kanari (2001) |

With respect to biotic raw materials, mitigation could focus on replacing fossil fuel-based materials with forest-based materials in the construction sector and in long-lasting products such as furniture, etc., which will increase biotic carbon storage. Furthermore, promoting cascade use, reuse and recycling of wood is expected to improve efficiency in wood use and maximise the mitigation potential of the sector.

In a commodity’s supply chain, GHG emission hotspots and potential emission cuts can vary strongly according to the material´s features. They also depend on whether most emissions come from energy use or from other industrial processes, and on the availability of cleaner energy options.

The raw material industry has already made significant efforts to reduce emissions. Some examples are the optimization of industrial processes such as steel production, the increase of production based on secondary materials, electrification, and the use of biomass and waste as fuel and for heat generation (in paper industries). Yet, significant challenges remain. For instance, the reliance on fossil fuels used for ventilation, drilling, etc., is high in mining operations, especially in remote areas. Moreover, the average energy demand per mining output is expected to increase due to the trend of decreasing ore grades and more stringent mining conditions. Process-related emissions, often having been optimized for decades, do not show significant potential to be reduced further. In the case of the raw materials sector, this is also due to the composition of materials. Apart from the challenges to reducing GHG emissions per unit of material production, the increasing global demand for minerals, metals and biotic products challenges the GHG emissions´ mitigation needed to combat climate change.

Further reduction of GHG emissions in the EU economy in general, and in the raw materials sectors in particular, may be also limited by potential bottlenecks in the supply of certain materials required for the deployment of low-carbon technologies (see dedicated section above). In addition, the manner of sourcing materials needed for the low–carbon economy will determine its overall contribution to sustainable development and a peaceful world, since materials extraction in some world regions can reinforce weak governance.

Mitigation could also be constrained by a limited availability of quality secondary raw materials, whose use as inputs to production, as indicated above, generally helps reduce GHG emissions. The current limited uptake of secondary raw materials is partly due to the downgrading of material after recycling and the need for quality standards for secondary raw materials. The EU has a consolidated recycling industry for some materials (e.g. aluminium, copper and iron), which supplements the inputs to production from primary sources. However, the road towards a more circular use of raw materials is long, especially for some critical materials that are key enablers of low-carbon technologies. Moreover, significant amounts of potentially recyclable waste are leaving the EU in the form of used products, waste and scrap. There is no evidence as to whether this exported waste and scrap is handled in an efficient/circular way and is actually contributing to the production of secondary raw materials, thereby reducing GHG emissions globally. While these outflows increased significantly in the past decade, trends may change due to the dynamic nature of the global market. For instance, some major importers of waste from the EU have introduced bans on that trade.

Power generation is one of the major contributors to climate change. Low-carbon technologies play a fundamental role in the transition towards a clean, secure and sustainable energy system. This includes wind power, solar photovoltaic, electricity grid and bioenergy technologies, which are prioritised in the EU's Strategic Energy Technology (SET) plan, and expected to see a significant increase in market share according to the energy market scenario outlined in the EU Energy Roadmap 2050.

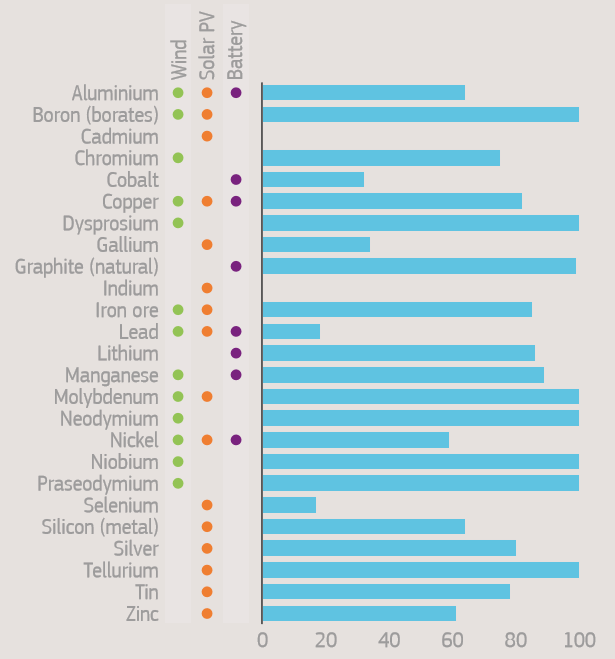

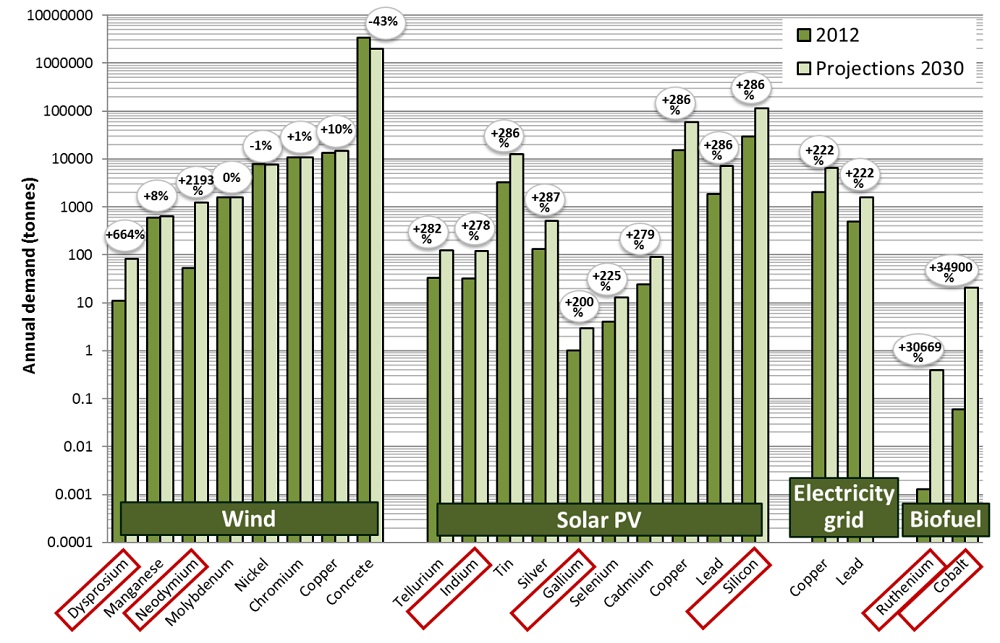

Raw materials are and will be indispensable for sustaining the development and large-scale deployment of such technologies. Currently, the EU relies on imports of raw materials needed for renewable energies, such as manganese, chromium, cobalt and copper (Figure 9).

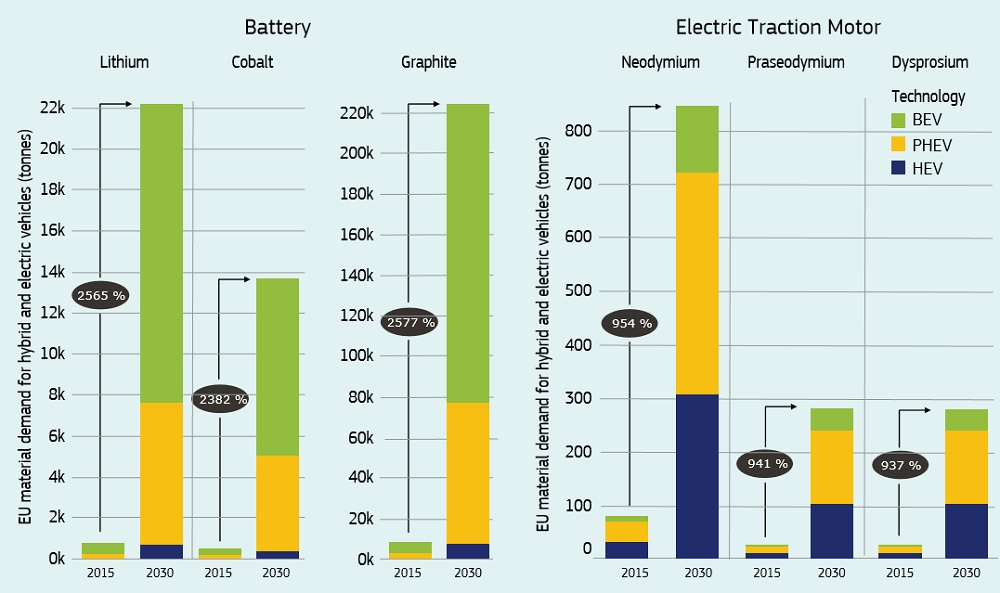

Many of the relevant materials required for low-carbon technologies are considered critical raw materials (Figure 9 and Figure 10). Moreover, several of these materials are also used by competing applications, e.g. electric vehicles and wind power, and demand is increasing at an accelerated pace globally, which may challenge the deployment of low-carbon technologies through possible bottlenecks in supply of materials.

Although the market may move towards wind or solar photovoltaic technologies that will require less critical materials per kWh generated, through increasing material efficiency and substitution, the demand for most raw materials used in these technologies is still projected to increase by 2030 (Figure 10). For example, the annual demand for raw materials used in solar PV technology is projected to increase on average by 270 % by 2030. For wind power, demand for dysprosium may increase by about 660 % and neodymium by about 2 200 %, due to the increase in market share of rare earth-based generators in both onshore and offshore wind applications.

Furthermore, to enable transmission of electricity from dispersed and concentrated renewable sources, for example, from offshore wind applications, a 'smart' electricity system needs to be developed, including installation of submarine cables. Such cables will require copper and lead.

As a viable alternative to fossil fuel in the EU's transport sector, biofuels will also help to reduce GHG emissions and improve the security of fuel supply within the EU. However, sustainable biofuel production relies on specific catalysts, which are based on cobalt and ruthenium metals. The demand for these metals by 2030 is expected to be over 300 times today’s level.

Electro-mobility is also essential for a broader shift towards a modern, low-carbon and circular economy. It can help reduce EU GHG emissions and improve air quality in cities. According to the European Roadmap for Electrification of Road Transport, over 5 million electric vehicles should be on EU roads by 2020, increasing to 15 million by 2025. To accomplish emission reduction goals, according to Blagoeva et al. (2016), even more ambitious targets are sometimes put forward, e.g. as many as 8-9 million electric vehicles on the road by 2020, with further increases in electric vehicle sales beyond 2025. Higher quantities of critical and non-critical raw materials will be necessary to sustain this future uptake of electro-mobility (Figure 11).

For decarbonisation of the EU economy in line with the 2030 and 2050 targets and the European Green Deal, all sectors need to cut emissions.

The EU Emissions Trading System (EU ETS), a cornerstone of EU policy to combat climate change, was created with the idea of promoting reduction in emissions where it proves more cost-effective. It covers specific sectors such as the production of metals, cement, lime, glass, pulp and paper (in some cases only in facilities above a certain size). Other subsectors of the raw materials industry that do not fall within the EU ETS, such as the waste and transport sector, are regulated by the effort sharing decision, which sets national emission targets for 2020.

The EU ETS, now in its Phase 3 (2013-2020), allows free allocation of GHG emission allowances to the best performing installations, while installations not meeting the best performers’ benchmarks must cut emissions and/or buy carbon credits (also called emission permits). In addition to emission allowances, the climate policy also gives facilities the possibility of buying a limited amount of international credits from emission-saving projects around the world.

The EU ETS scheme considers that some industries competing in the global market may be more exposed to so-called carbon leakage, i.e. shifting industries to other countries outside the EU with laxer GHG emission constraints. With the aim of avoiding this leakage, industries included in the official list of sectors possibly exposed to carbon leakage may be entitled to higher shares of free emission allowances. Many of these are energy-intensive industries producing raw materials.

The latest revisions of the EU ETS scheme tend to reduce the amount of free emission allowances and increase the share of auctioned allowances, where installations have to pay for emission allowances, provided these are available. However, the free allocation of emission allowances will continue until 2030, to keep on rewarding the best performers. This is partly because, as highlighted in the 2030 climate and energy policy framework, keeping key enabling industries within the EU is important for EU industrial competitiveness. Moreover, a High Level expert Group on energy-intensive industries, led by DG Internal Market, Industry, Entrepreneurship and SMEs, has been set up to promote a smooth transition to a low-carbon economy, and provide the Commission with advice and expertise on the challenges faced by these industries.

To help achieve its climate goals, the EU is determined to integrate climate action (mitigation and adaptation) into all major EU spending programmes and proposes to further strengthen climate action.

So far, the Commission has promoted low-carbon technologies through the Sustainable Industry Low Carbon (SILC) programmes. In parallel, among many other funding initiatives, the biggest research and innovation programme in the EU, Horizon 2020, is supporting the development of enabling technologies in resource and energy efficiency. The new research and innovation programme currently under discussion, Horizon Europe, will target the decarbonisation of energy-intensive industries. The next EU ETS Phase (4) will also itself support industry and the power sector through several low-carbon funding mechanisms, and will include reserves for the deployment of innovative renewable energies and technologies such as carbon capture and geological storage (CCS).

In addition, NER 300 is one of the world's largest funding programmes for innovative low-carbon energy demonstration projects, and also seeks to leverage a considerable amount of private investment and/or national co-funding across the EU. NER 300 is intended as a catalyst for environmentally safe CCS and innovative renewable energy technologies on a commercial scale within the EU, involving all Member States.

Alongside this, the EIT Climate-KIC is the European knowledge and innovation community that identifies and supports innovation contributing to mitigation and adaptation. It provides support to several initiatives aimed at reducing industrial GHG emissions.

There are also many potential synergies between measures promoted in the context of climate mitigation policies and those developed in the context of the circular economy. The latter promotes resource efficiency, recycling and enhanced waste management, to reduce negative environmental and social impacts, and to boost EU competitiveness and the security of the EU supply of materials.

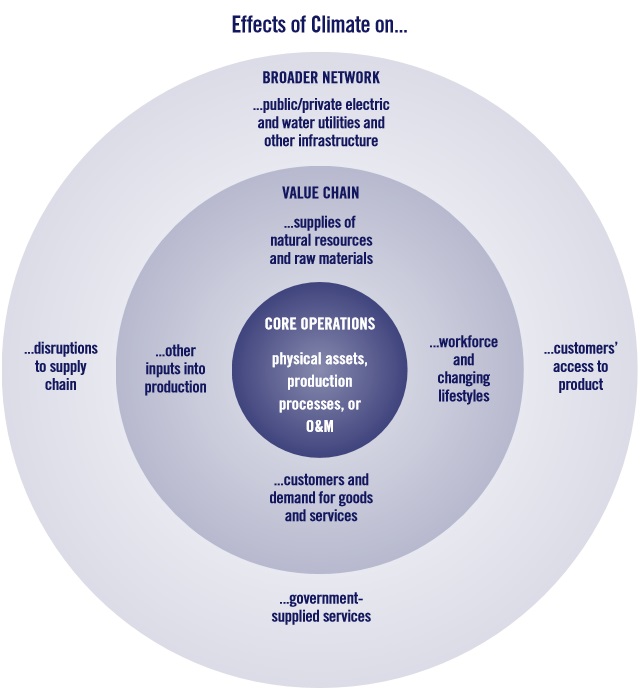

Climate change itself is also expected to have an impact on the production of raw materials. For instance, some of the world’s largest mining facilities operate in climate sensitive regions. Adaptation (anticipating and taking measures to minimise damage from climate change) may be needed to ensure a sustainable and secure supply of raw materials.

Any business can be impacted by climate change at several levels: direct impacts on operating facilities, impacts on the supply/value chain, and further impacts in other related aspects (Figure 12). These impacts could include for instance increasing water shortages, which may trigger water competition problems, closely linked to public acceptance of operations; flooding, which could damage mining infrastructures such as tailings, dams; etc. Limitations may also arise in the availability of energy, e.g. due to decreasing water flows in rivers used for hydropower generation. The International Council on Mining and Metals (ICMM) provides an overview of the main climate-related challenges faced by the mining sector.

Furthermore, climate change may damage forests’ adaptive capacity, while at the same time increasing pressures on forests such as disturbances through storms, fire, pests and diseases. This may impact forest growth and production capacity, and affect the function of forests as carbon sinks. The economic viability of forestry may be affected, mainly in southern areas of Europe. These and other challenges for the forest sector are addressed by the EU Forest Strategy.

RMIS related sections

Decarbonisation

- Climate Action, ‘EU action’

- DG GROWTH, ‘Towards a climate-neutral economy’

- SITRA – ‘The circular economy – a powerful force for climate mitigation’

Energy and climate

- European Commission, ‘A European Green deal’

- ‘Monitoring progress towards the Energy Union objectives – key indicators [SWD (2017) 32]’

Raw materials for low-carbon technologies

- International Institute for Sustainable Development, 2018, ‘Green Conflict Minerals: The fuels of conflict in the transition to a low-carbon economy’.

- Kleijn, R., van der Voet, E., Kramer, G.J., van Oers, L., van der Giesen, C., 2011, Energy 36, 5640–5648, ‘Metal requirements of low-carbon power generation’.

- Strategic Energy Technologies Information System (SETIS), ‘Critical materials in low-carbon technologies’